Stocks & Shares Individual Savings Account – ISA

Invest up to £20,000 a year tax-free with a Stocks & Shares ISA

The value of your investments and the income from them may go down as well as up, and you could get back less than you invested.

Tax treatment depends on the individual circumstances of each client and may be subject to change in the future.

What is a Stocks & Shares ISA?

A Stocks & Shares ISA – or Investment ISA – is a tax-efficient investment account. It’s good to remember ISA rules can change and their benefits depend on your circumstances. You can:

Maximise generous annual allowances

Invest up to £20,000 each tax year and up to £9,000 for children in a Junior ISA. For a family of four this equates to a tax-free allowance of £58,000 a year.

Keep more of your money

Leave your money to grow year on year – there is no income tax or capital gains tax due on anything your ISA investments earn.

Access a wide range of investments

Bestinvest offers a huge range of quality investments including shares, funds, investment trusts and Exchange-traded funds (ETFs) – or you can choose a risk-rated Ready-made Portfolio.

Withdraw your money anytime

…unlike some fixed-term cash ISAs. But do remember investing is for the long term – we suggest at least three years – as the value can go down as well as up.

Who can have a Stocks & Shares ISA?

Almost anyone! Just so you know:

- You need to be at least 18 years old. Junior Stocks & Shares ISAs are available for children too

- It’s important that you’re a UK resident for tax purposes

- You can have a Stocks & Shares ISA with as many providers as you like but your total contributions across all ISAs each tax year must not exceed £20,000.

Investments for your ISA

The performance of your ISA depends on the success of the investments you choose. When you become a Bestinvestor, we’ll make sure you have everything you need to succeed.

Funds

Access investment opportunities across different sectors and around the world. Take your pick from almost 2,000 funds including ETFs and investment trusts. It’s easy to look for the ones you want with comparison tools and insightful fund factsheets.

Shares

Whether it’s big-name US brands or familiar UK-listed companies you want for your ISA, Bestinvest has you covered. Our investment search tool makes it easy for investors to browse our big range of quality UK and US shares.

Ready-made Portfolios

Ready-made Portfolios give you the option to buy a portfolio built and managed by the investment team at Evelyn Partners, our parent company (they manage over £50 billion). Once you’ve picked the portfolio you want, you don’t have to do anything else. Our experts will do the rest.

Start thinking about tomorrow, today

Open a Stocks & Shares ISA and bring your goals forward

Why choose Bestinvest for your Stocks & Shares ISA?

You’ll find everything you need at Bestinvest to make a success of your Investment ISA:

Big investment choice

Choose from 1000s of investments including funds, ETFs and investment trusts, plus UK and US shares. Don’t want to pick your own investments? Go for a Ready-made Portfolio

Excellent value for money

Tiered service fees from 0.2% a year for Ready-made Portfolios and 0.4% a year for other funds. It’s free to set up, buy and sell funds. It’s £4.95 per online trade for UK shares, no online dealing fees for US shares and a 0.95% foreign exchange fee

Open your Investment ISA in minutes

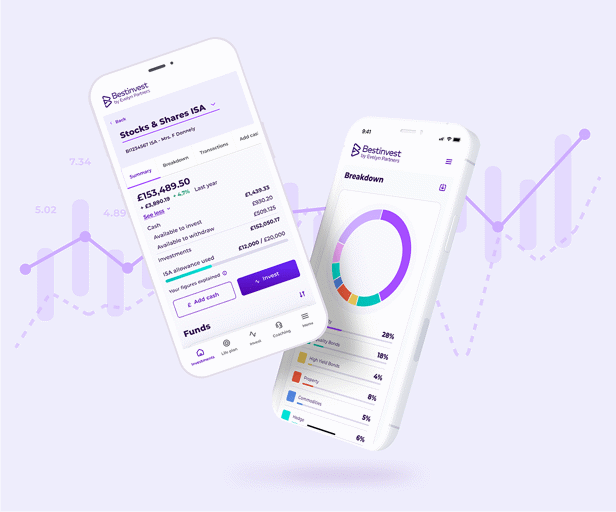

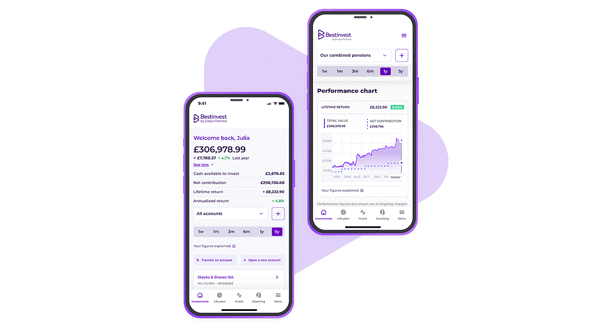

Open your account and start investing in minutes. You can manage your investments online or through the Bestinvest app

Free coaching, tools and resources

Get more from your investment choices with tools and resources such as investment guides and free 45-minute coaching sessions whenever suits you with no ongoing commitment.

Award-winning service

We’ve won many awards for our products and services since the 1980s, including Boring Money Best Buy ISA winner (2023) and Best Stocks and Shares ISA Provider at the second Online Money Awards

Free investment coaching

Got questions about investing? Our Bestinvest Coaches are qualified financial planners, they can help you understand if your investment choices line up with your objectives and the level of risk you’re willing to take when investing.

Coaching services are not regulated by the Financial Conduct Authority.

How much does it cost to invest in a Bestinvest Stocks & Shares ISA?

Account fees for our cost-effective and award-winning Stocks & Shares ISA depend on the value of the investments in your ISA and the type of investments you choose. Our service fees for instance are capped at 0.4% per annum for funds and UK shares, and 0.2% a year for one of our risk-rated Ready-made Portfolios.

Please note the images here shows what our online investor tool, Grow my money looks like.

Get started

Open an ISA

It's easy to open an ISA online. Simply enter your details and get investing in minutes.

Need an ISA for a child?

Give your child a financial boost by investing in a Junior Stocks & Shares ISA on their behalf.

Top up your ISA

Your tax allowances reset on 6 April so it’s use or it lose it time to make the most of your allowances up until 5 April every tax year.

Frequently asked questions about Stocks & Shares ISAs

What’s the minimum amount I can invest in a Stocks & Shares ISA?

With Bestinvest you can invest from as little as £50.

Can I pay cash into an investment ISA?

Yes, you can add cash to your Stocks & Shares ISA and leave it there until you’re ready to invest. Your money does not sit idle – Bestinvest cash balances earn 3.95% AER (as of November 2024). It’s good to know that our cash rate is set by our custodian (SEI investments) and is subject to change without notice.

Can I transfer other ISAs into the Bestinvest ISA?

Yes. First, you’ll need to open a Bestinvest account and then it’s just a few simple steps to get your ISA transferred. We’ll even pay up to £500 towards any exit fees your existing ISA provider may charge – terms and conditions do apply.

How do I choose the best Stocks & Shares ISA provider?

There’s no such thing as the best stocks and shares ISA provider. It really depends on what you’re looking for. Some ISA providers offer a huge range of investments but not much in the way of support to help you get the best from your ISA. Others offer a limited range of investments. Bestinvest offers a broad range of investments and free investment coaching from qualified financial planners, so you are fully supported on your investment journey.