Start Bestinvesting today

Three steps to get started investing with us today.

The value of your investments and the income from them may go down as well as up, and you could get back less than you invested.

1. Choose and open your account

Stocks & Shares ISA

Invest up to £20,000 each tax year in the stock market and keep your gains tax free. Tax treatment may change.

Self-invested Personal Pension (SIPP)

Planning ahead for retirement? Get flexibility with a Self-invested Personal Pension.

Junior ISA

Get your children started with tax-free investments of up to £9,000 each tax year. Tax treatment may change.

Investment account

A simple, convenient account for your investments with no annual limit on how much you can invest.

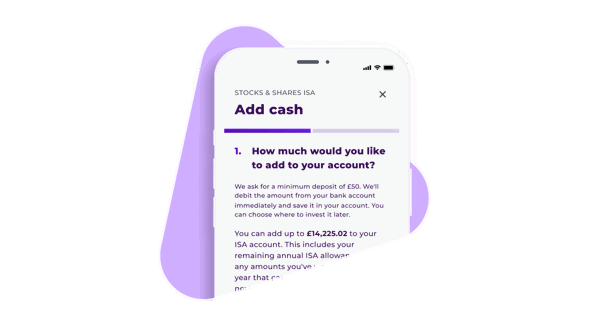

2. Add money or transfer your investments

With your account open, you can add money to it how you want:

- Fund your account with cash using a debit card and get started right away

- Set up a Direct Debit to top up your account with cash or purchase investments each month

- Transfer your investments from another provider into your new account

3. Start investing

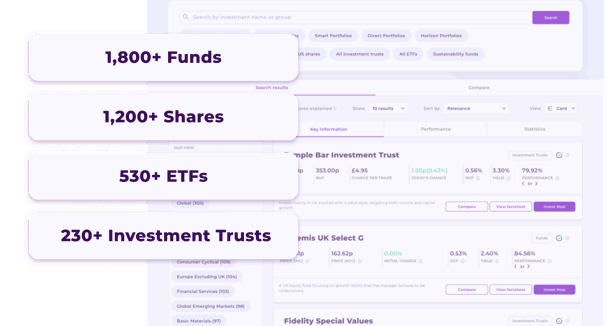

Choose from our range of Ready-made Portfolios or pick your own investments from over 3,000 shares, funds, Investment Trusts and Exchange-traded funds (ETFs).

And if you need some inspiration, the Best™ Funds List* lets you tap into our insights to help you choose from thousands of funds.

*The Best™ Funds List is a trademark of Bestinvest.

Reasons to invest with Bestinvest

Great value for money

Pay as little as 0.2% per year in services fees on your Ready-made Portfolio or 0.4% for other investments. Buy and sell UK shares online for only £4.95 per trade - one of the lowest dealing fees of all the major investment platforms. Other dealing fees may also apply.

Free investment coaching

Speak to one of our Coaches for free. No obligation, no catches. Our Coaches hold the Level 4 qualification in financial planning from the Chartered Insurance Institute (CII).

Advanced goal planning

Plan and personalise your investment goals and see how small changes could help you reach them.

Investment insights

Choose from a wide range of shares, funds and ETFs, supported by our fund factsheets, guides and articles.