Calling Generation X – your pension needs attention

While attention focuses on the disparity between cash-strapped millennials and baby boomers who have benefitted from gold-plated final-salary pensions and house price inflation, the pension challenges faced by Generation X have gone almost unnoticed. In this article we highlight Generation X’s predicament and set out steps to help people in this age bracket take control of their retirement savings.

The value of investments can fall as well as rise and that you may not get back the amount you originally invested.

Nothing in these briefings is intended to constitute advice or a recommendation and you should not take any investment decision based on their content.

Any opinions expressed may change or have already changed.

Published on 13 May 20206 minute read

How to get your pension working for your future (there’s still time)

Generation Xers are those born between 1965 and 1984 and, if that’s you, you won’t need reminding that you’re the generation that – unless you were incredibly lucky – is too young to have benefited from a final salary pension and too old to reap the benefits of auto-enrolment, which didn’t kick in until 2012. Thinking back, easy-to-manage pensions such as SIPPs (Self-invested Personal Pensions) didn’t even really exist until further into your careers.

All of this means that many Generation Xers find themselves in an uncomfortable position when it comes to thinking about paying for life after work... a life which, thanks to rapid rises in life expectancies, could last as long as working life!

So what's to be done? Well at Bestinvest, we don’t go in for peddling doom and gloom statistics or scaremongering. Instead, we’re here to offer practical support and help you to make the very best of the money you do have because that cliché, ‘it’s never too late’ really does ring true. Here’s what we suggest:

Step 1 – what do you have in the way of pensions already?

Reacquaint yourself with any pensions that you’ve already got. This means finding out:

- How much they are worth

- What you are currently paying in

- What you are investing in

- The charges you are paying

You should find this information on your pension statements or you can give you pension provider a ring. Alternatively, call us on 020 7189 9999 and we can help you decipher your pension paperwork.

If you’ve lost track of any of your pensions, the Government’s Pension Tracing Service can help reunite you. You can call them on 0800 731 0193.

Step 2 – the importance of good pension investments

Now you know what you’ve got, it’s time to see what you can do to get your pension working harder . Why is this important? Because your pension is an investment and the harder your investments work (i.e. the more they grow), the more money you’ll have in the future.

Remember the value of your investments can go down as well as up.

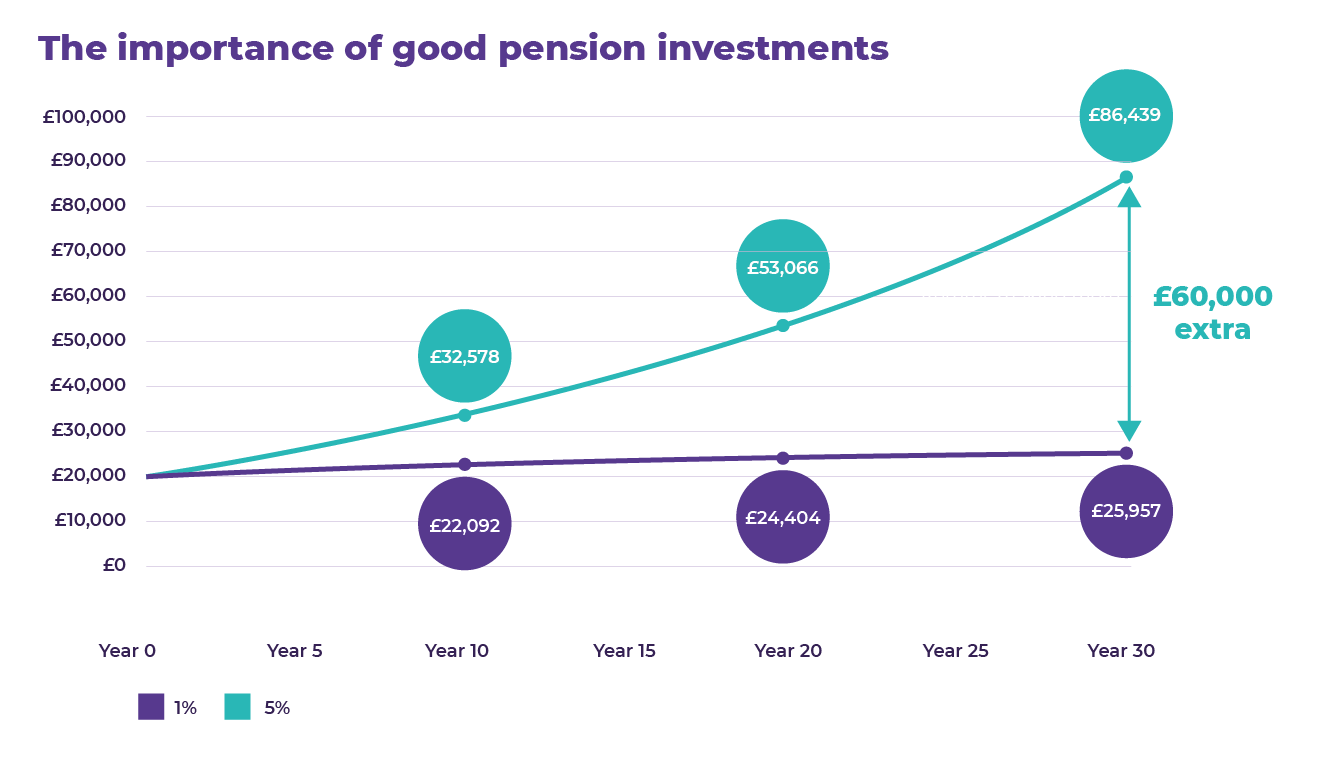

To see this in action, have a look at the graph below.

The graph is based on investment returns of 1% and 5% per annum (exclusive of any fees which may vary from provider to provider), compounded annually. All figures quoted are for illustrative purposes only.

It shows two £20,000 pensions that have been left untouched for 30 years. The first is full of good investments that generate a 5% annual return, and the second has worse investments that pay out 1% a year.

Why it pays to know what your pension is invested in

Over 30 years we can see the first pension growing to £86,439 – that’s nearly £60,000 more than the second! Of course, not everybody has three decades to let their pension grow before they retire, but even over 10 years, the first pension outpaces the other by more than £10,000.

Choosing the right investments

Choosing the right investments is the key – Our Top-rated Funds guide can help you get started. But do bear in mind that not all pensions give you access to a big range of decent quality investments. This is why many people choose SIPPs*, which give you more choice and control over your investments. Find out more about SIPPs.

Step 3 – Don’t pay too much in pension charges

Costs, fees, charges – whatever you want to call them. This is the money you pay to your pension provider in exchange for them looking after your pension and investing the money you pay into it. The amount you pay varies dramatically across different providers and, again, this can have a big impact on the amount of money you’ll have in the future because the more money you pay in pension charges, the less you’ll have to invest.

What can I do about this?

If you think you’re paying too much, it’s actually quite easy to change pension provider. New electronic transfers mean it often takes as little as two weeks (although some older style pensions can take up to 12 weeks). It doesn’t always make sense to move a pension, so do check yours carefully before making a decision and seek professional financial advice if you are unsure.

Step 4 – Can you pay more into your pension?

Can you afford to pay more money into your pension? Even small amounts can make quite a big difference over time so if you can, it’s definitely worth doing. First of all, because the Government wants you to save for the future, it actually tops up your contributions via tax relief and your pension should also benefit from the impact of compounding if you can leave it invested for a number of years.

Prevailing tax rates and reliefs depend on your individual circumstances and are subject to change.

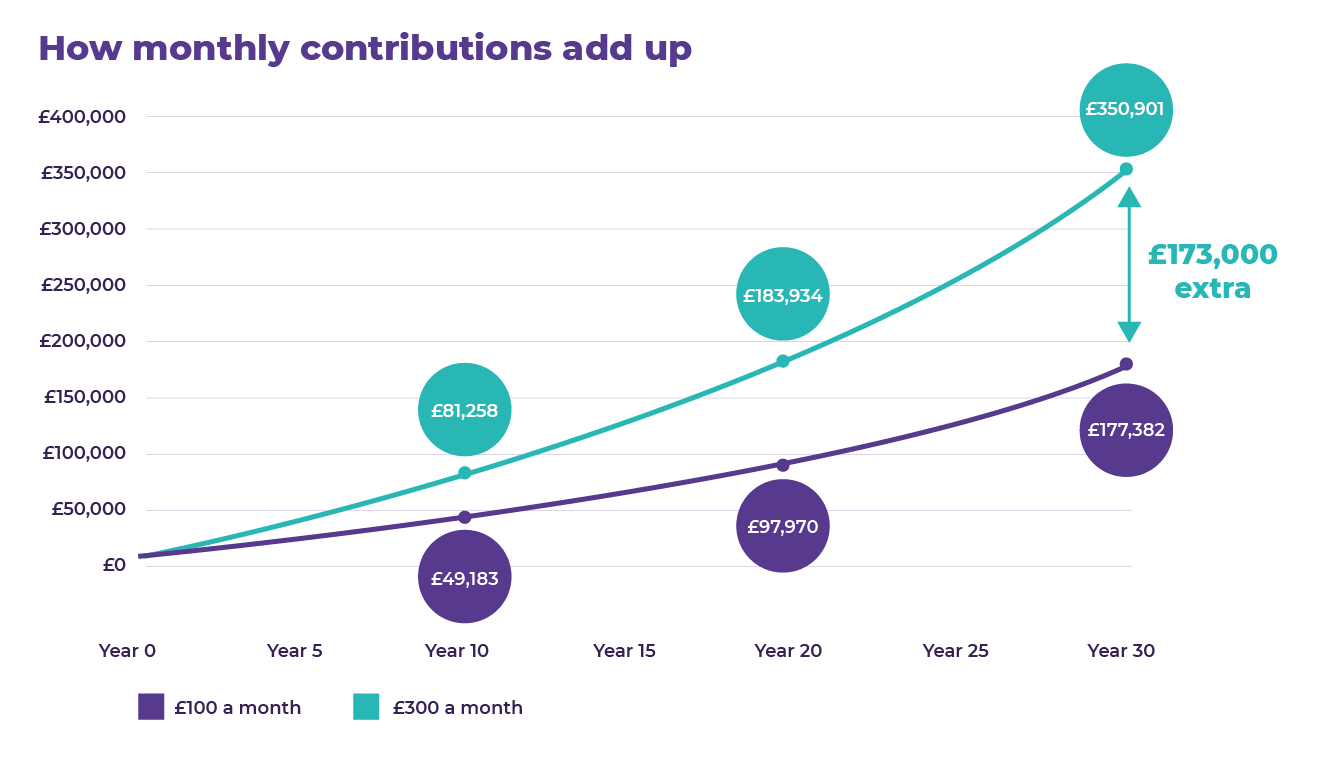

Here’s an illustration to show you how this works.

This graph shows how two pensions (that hold the same investments) grow over time. As you can see, the £300-a-month pension is growing at a much faster rate than the £100-a-month equivalent. Of course, this isn’t too surprising as more money is being paid into the pension! But it is also benefiting from the power of compounding – the snowballing effect of investment returns generating more returns. And as the graph shows, with compounding this small monthly difference can add up to a huge amount over time – so it makes sense to pay in as much as you can each month.

Step 5 – Get going

You can make a difference to your life in retirement if you get going. Here are some resources to help you.

Looking for pension investment inspiration?

Read Our Top-rated Funds for a huge selection of the funds that our experts believe are the most likely to deliver for you over the long term.

Do you want to transfer your pension?

Consider our multi award-winning Best SIPP. The Best SIPP can make an excellent home for old personal and workplace pensions and is a popular choice for people wanting to keep all their pensions in one account**.

With the Best SIPP, you’ll be able to choose from a big range of high-quality investments and we’ll give you lots of investment ideas to help you make the most of your money. It comes with low fees and is easy to manage online – although we also have a friendly telephone team to answer any questions you have. Find out more.

When you transfer to Bestinvest, we’ll pay up to £500 towards any exit fees*** that your existing pension provider charges.

Would you like to talk to a Coach about your pension?

If you know your pensions need some attention or you just want to make sure you’re doing all you can, why not book a free call with one of our Coaches.

Important information

The value of an investment may go down as well as up, and you may get back less than you originally invested.

This article does not constitute personal advice. If you are in doubt as to the suitability of an investment please contact a financial adviser.

*SIPPs are not suitable for everyone. If you don’t want to invest across different asset classes or don’t think you will make use of the investment choices that SIPPs give you, then a SIPP might not be right for you.

**Before you consider transferring a pension, it is important to ask yourself: Will I lose any valuable benefits or features from my existing pension plan? Will I incur any penalties on my existing pension if I transfer? Is it an occupational final salary pension scheme? (In which case it is very unlikely to be advisable to transfer). Have I considered the charges on my current plan? (A new arrangement may be more expensive – especially if you have a stakeholder pension).

*** Terms & Conditions apply.

Get insights and events via email

Receive the latest updates straight to your inbox.

You may also like…

Pensions and retirement

10 pension tax benefits and pitfalls to know about

Pensions and retirement