Overhauling your pension: make pensions work for you

Putting your hard-earned money away for retirement is all well and good, but if the money isn’t working hard for you in return, you could be missing out. We can help you overhaul your pensions to make sure you don’t lose out in the long run. This article shows you how.

The value of investments can fall as well as rise and that you may not get back the amount you originally invested.

Nothing in these briefings is intended to constitute advice or a recommendation and you should not take any investment decision based on their content.

Any opinions expressed may change or have already changed.

Published on 14 May 20205 minute read

Find old pensions

Did you know that the Government now plans to give away the pensions you’ve forgotten about – all £20 billion of them*– to the National Lottery Community fund?

It’s easy to misplace or forget about a pension, but you could stand to lose your money if you don’t track them down. To get started tracing old pensions (if possible) you need to find your old pension paperwork or contact the provider(s) – if you can remember who they are – and figure out how much you already have as a starting point.

If you can’t find your paperwork or don’t know the name of the provider, it’s still easy to get your hands on the information. You can use the Government’s free pension tracing service by calling 0845 6002 537.

Add up how much you have in total and you could be pleasantly surprised! But don’t worry if you haven’t got as much as you want or if you think you can do better, there is plenty you can do.

Check your pension fees

Are you paying too much in pension fees? Costs vary dramatically and older pensions in particular can have big fees to pay. These fees eat into your returns, especially over long periods of time, leaving less for your future.

If you have more than one pension provider, you’re paying multiple provider fees which again may eat away at your money. If you’re not sure whether you are paying too much, give us a call on 020 7189 9999 and we can help you decipher your statements.

Or you can book a free call with one of our Coaches where they can talk to you about your pensions in more detail.

How are your investments performing?

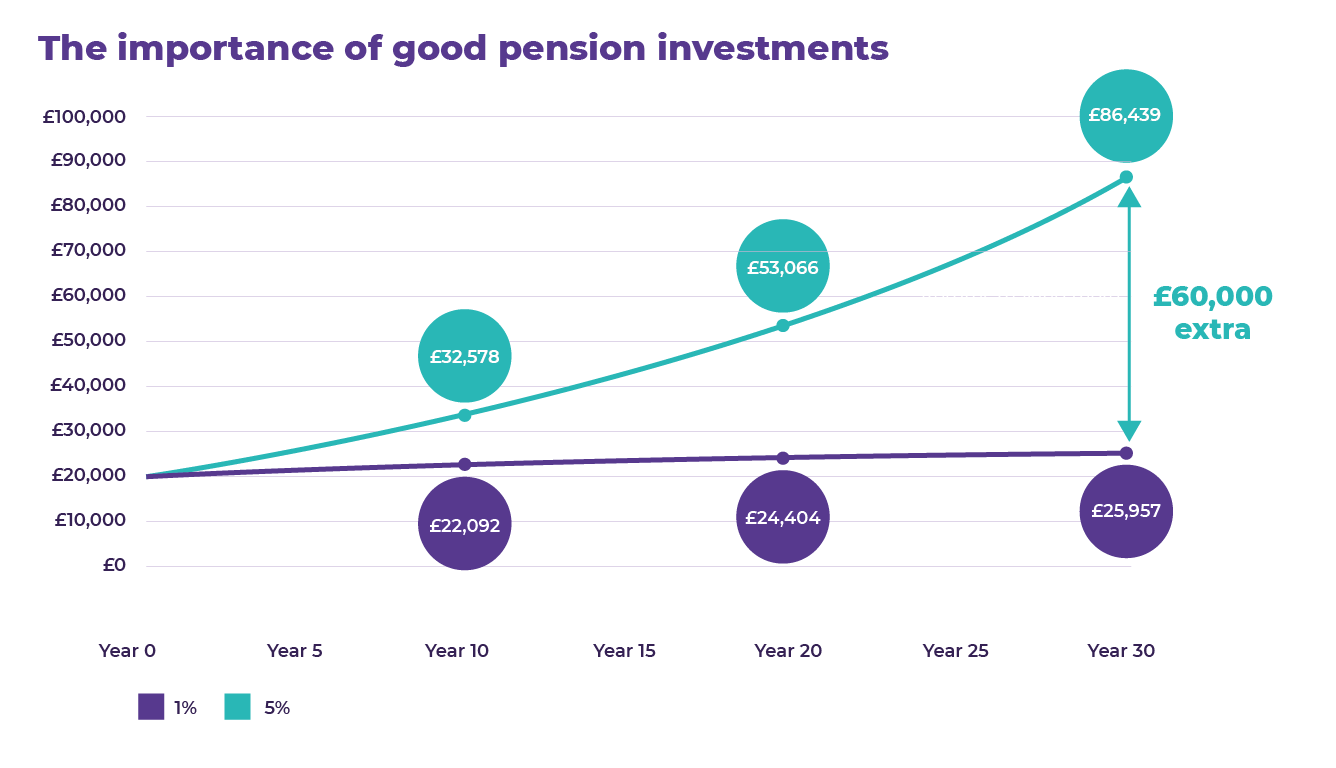

You can see how your investments are performing when you review your pensions. Poorly performing investments can have a massive effect on your returns over time. Take a look at our graph to understand why pension performance matters.

The graph is based on investment returns of 1% and 5% per annum (exclusive of any fees which may vary from provider to provider), compounded annually. All figures quoted are for illustrative purposes only.

Why it pays to know what your pension is invested in

Over 30 years you can see the first pension growing to £86,439 in the graph – that’s nearly £60,000 more than the second.

Choosing the right investments is essential to help grow your pension as much as possible before you reach retirement (but remember – investments can go down as well as up). The good news is that it’s actually much easier than many people think to choose good investments. There is lots of information available to help you, but as not all pensions give you access to a wide range of investments, you may need to switch to a more flexible pension (but it depends on a number of factors and you have to make sure it is the best option for you) – such as a SIPP** – to make the most of the opportunities.

Our Best SIPP is a great way to get started. There are a wide range of investments to choose from and you can take look at them in Our Top-rated Funds guide.

How much are you paying in?

Can you afford to pay more into your pension? You might not be paying as much into yours as you can, but the more you pay in, the more your investments have the potential to grow for retirement.

Even small amounts can help, so it’s a good idea to check up on your pension to see if you’re using as much of your pension annual allowance as possible.

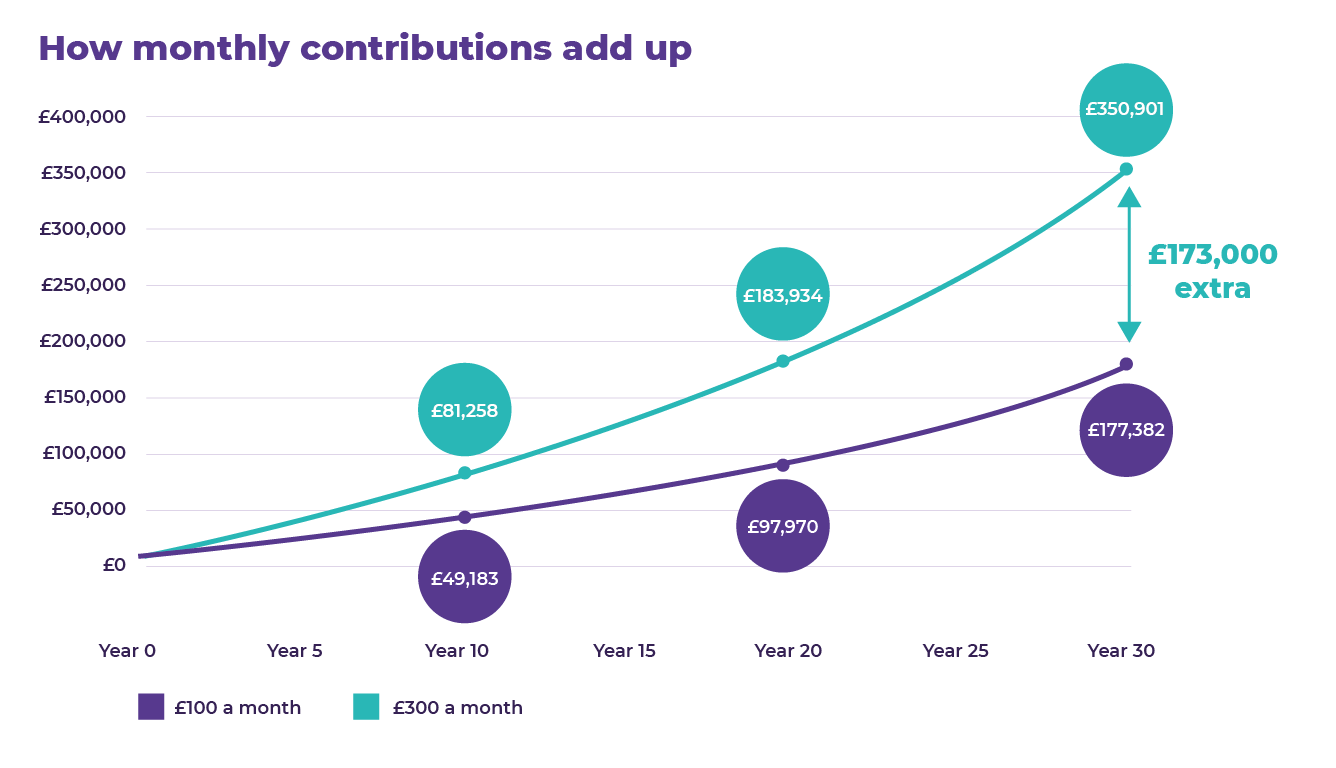

This graph shows how two pensions (that hold the same investments) grow over time. The £300-a-month pension is growing at a much faster rate than the £100-a-month equivalent. Of course, this isn’t too surprising as more money is being paid into the pension, but it also benefits from compounding – the snowballing effect of investment returns generating more returns. Einstein apparently called compounding the 8th Wonder of the World!

Consider consolidating with us to gain more control

Pension consolidation – having your pensions in one place – makes them easier to manage. You can keep an eye on them because one account means one balance, so it’s easy to review how much you’re paying in fees as well as investment performance. Our Best SIPP is a great option for your personal and workplace pensions. We give you plenty of investment ideas along with a large range of high-quality investments to help you make the most of your money.

It’s quick and easy to transfer to us***. We can do all the paperwork and with new electronic transfers, you can be set up and ready to go in as little as 15 days (some paper-based pension transfers from older providers can take longer). And what’s more, we put £500 toward any exit fees you may receive from your previous provider****.

Find out more about transferring your pension to Bestinvest.

Important information

The value of an investment may go down as well as up, and you may get back less than you originally invested.

This article does not constitute personal advice. If you are in doubt as to the suitability of an investment please contact a financial adviser.

*Money Saving Expert, 23 October 2018

**SIPPs are not suitable for everyone. If you don’t want to invest across different asset classes or don’t think you will make use of the investment choices that SIPPs give you, then a SIPP might not be right for you.

***Before you consider transferring a pension, it is important to ask yourself: Will I lose any valuable benefits or features from my existing pension plan? Will I incur any penalties on my existing pension if I transfer? Is it an occupational final salary pension scheme? (In which case it is very unlikely to be advisable to transfer). Have I considered the charges on my current plan? (A new arrangement may be more expensive – especially if you have a stakeholder pension).

**** Terms & Conditions apply.

Get insights and events via email

Receive the latest updates straight to your inbox.

You may also like…

Pensions and retirement

10 pension tax benefits and pitfalls to know about

Pensions and retirement