Focus on the long term to navigate volatile markets

Our analysis shows the importance of taking a long-term view during these challenging market conditions.

The value of investments can fall as well as rise and that you may not get back the amount you originally invested.

Nothing in these briefings is intended to constitute advice or a recommendation and you should not take any investment decision based on their content.

Any opinions expressed may change or have already changed.

Written by Daniel Casali, Chief Investment Strategist

Published on 31 May 20227 minute read

Key points:

- Take a long-term view. Over the long term and after inflation, US equities have, on average, returned more than 6.5% a year1

- It’s time in the market that matters, not timing the market. Our analysis shows that just missing out on the 10 best days in the UK stock market over the last 35 years reduced returns by 50%2

- It’s important to remain diversified. A diversified approach could increase returns by up to 3% a year3

The global economy and stock markets faced several headwinds as this year began, and we saw markets fall in January as investors weighed up the outlook. The S&P 500 was down 5.86%4 for the month, whilst the UK 100 largest companies performed slightly better and were only down 0.54%4. However, subsequent events, notably the Russian invasion of Ukraine, have caused markets to fall further and at the time of writing the S&P 500 is down 13.31%4 this year.

When markets have fallen to this extent, it is natural to be concerned during these challenging times. Of course, we share those concerns and understand that it is often tempting to do something, take control and make some changes. However, it is important to take a step back and think before acting.

So, what has happened?

Expectations of rising interest rates to temper rising inflation had already begun to lower growth expectations and in turn impact markets at the start of the year.

The announcement of major lockdowns in China caught many by surprise as there had been hopes the Chinese would drop their zero-Covid policy following the winter Olympics. The strict lockdowns meant that Shanghai’s port, which is the world’s largest, was running at a severely reduced capacity. This caused significant backlogs and exacerbated the disruption to global supply chains which has been a feature of the post-pandemic recovery. In addition, it raised concerns that Chinese economic growth would also slow as large parts of the economy were closed.

Then Russia’s invasion of Ukraine caught the world by surprise and took things to another level. It led to significant reassessments of the economic outlook and forecasts across the whole market. The war has directly impacted commodity prices, everything from oil and gas to wheat and sunflower oil. Russia and Ukraine are globally significant suppliers of a wider range of commodities. As a result, we have seen inflation, which was already rising, take off.

This inflation spike is feeding through to investor sentiment. High inflation increases the expectation of interest rate rises (which we are seeing). In addition, there are concerns the US Federal Reserve has lost control of inflation, having been initially slow to act.

How did this impact markets?

The impact on markets has been significant. The shift from a low inflation and low interest rate world, to one of higher inflation and higher interest rates led to a rotation in the stock markets. Technology companies, and as a result the US market, led markets lower. This is because higher-growth companies, which offer profits tomorrow have become less attractive when compared to lower-growth companies making reasonable profits today.

However, other areas have benefited, such as energy stocks for example, which are profiting from higher oil and gas prices. This has meant the UK stock market has held up well, as it is dominated by two oil giants: BP and Shell. However, once you take those companies out of the equation the performance is similar to the rest of the world.

How to navigate challenging markets?

During market down turns we find it helps to focus on the things that matter:

1. Take a long-term view

When markets fall it can be disconcerting and the desire to act is strong. This is when it is important to take a long-term view.

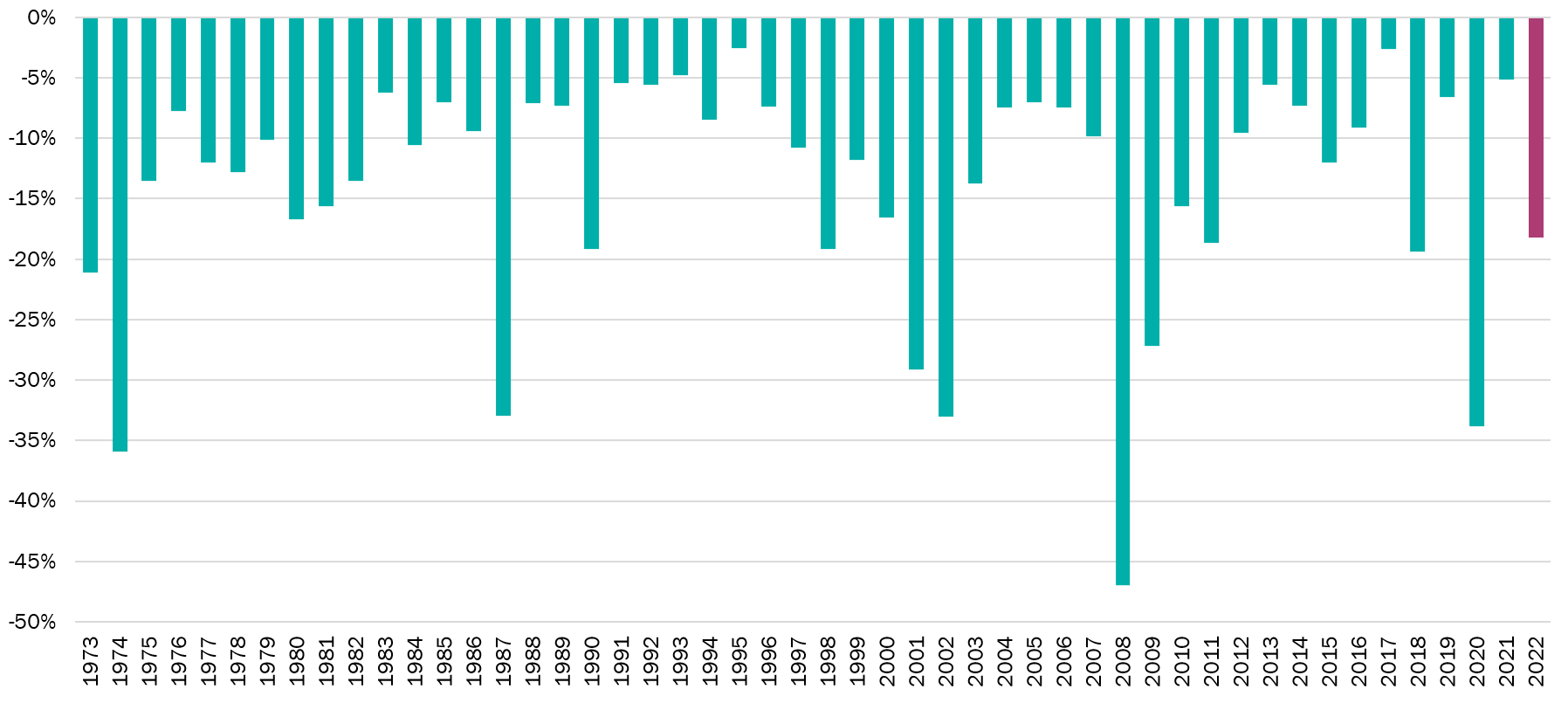

As professional investors we have been here before. Market falls are an unfortunate part of investing. The chart below shows that over the last 50 years, we have seen 12 drawdowns (peak to trough falls) of a comparable size, or greater, in the US equity market. Despite these setbacks, the S&P 500 is 3200% higher than at the start of 19734, not to mention the dividends paid out during that time.

Figure 1: Maximum annual drawdown for the S&P 500, 1973-2022

Source: Bloomberg, / Tilney Investment Management Services Limited, data as at 25/05/2022. Past performance is not a guide to future performance. The value of investments can go down as well as up and you can get back less than originally invested.

Simply put, the trend is for stock markets to rise longer term. Over the last 20 years, after inflation, US equities have, on average, returned more than 6.5% a year1. When combined with the power of compounding, which boosts investment returns, there remains a compelling case for maintaining equity exposure.

2. Time in the market matters, not timing the market.

During market corrections it may be tempting to cut your losses and move into cash. This is harder than it seems. Not only do you have to time your exit right, but you also must get your re-entry into the market right too. This means having the conviction to buy in at a lower level, which is often when the outlook is even more negative and investor confidence is at its lowest.

If you get the timing wrong the impact on performance can be huge. For example, if you invested £10,000 in 1986 in the UK Mid Cap’s and missed only the 10 best days your portfolio would be worth £25,1162. Whereas if you had stayed invested and done nothing it would be worth £45,3272. Whilst a potentially profitable strategy, we believe that for most clients it is too risky and more akin to speculating than investing.

3. Maintain diversification

Diversification is a crucial concept for financial markets. It helps reduce risk and volatility in a portfolio. It also helps deliver better returns for the risk taken, and the evidence backs this up. A 2019 study found that investors could increase their expected returns by up to 3% a year just by moving from a concentrated portfolio to a diversified fund with the same level of risk3.

Grounds for optimism?

There are reasons to be positive. The inflation spike is currently a short-term phenomenon. The main contributors, energy and food, are generally considered transient drivers of inflation as their prices can quickly go up and down. So, it is possible that inflation could ease back as the spike in prices works itself out of the system. If we start to see that happening, then markets could recover. The risk is the longer inflation remains high the greater the impact on the economy.

In the meantime, analyst’s forecasts have been improving through this year. Company earnings, as measured by Earning Per Share (EPS), are now expected to rise 11%, up from 7%4 which should support share prices. Many companies have also been able to pass rising costs through to their customers, with global profit margins hitting 40-year highs4.

It is these fundamentals that drive markets over the long term. If the global economy can avoid a recession in the next 12 months – economists currently assign a one-in-three chance for the US5 – and firms deliver on these estimates, then sentiment is likely to improve.

There’s no doubting that we’re in a challenging period for markets but taking a long-term view and focusing on the fundamentals should ensure investors are well positioned for when markets recover.

Important information

This article is solely for information purposes and is not intended to be and should not be construed as investment advice. Whilst considerable care has been taken to ensure the information contained within this article is accurate and up to date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information. The opinions expressed are made in good faith but are subject to change without notice.

The value of investments, and any income from them, can go down as well as up and you can get back less than you originally invested. Past performance is not an indication of future performance.

Issued by Tilney Investment Management Services Limited, authorised and regulated by the Financial Conduct Authority.

Sources

1 Copyright © 2022 Elroy Dimson, Paul Marsh and Mike Staunton / Tilney Investment Management Services Limited, data as at 25/05/2022

2 Refinitiv / Tilney Investment Management Services Limited, data as at 25/05/2022

3 Florentsen, B., Nielsson, U., Raahauge, P., & Rangvid, J. (2019). The Aggregate Cost of Equity Underdiversification. The Financial Review, 54(4), 833-856. https://doi.org/10.1111/fire.12212

4 Refinitiv

5 Bloomberg