Index funds – leading the charge

It’s often said that 'you get what you pay for' but with passive funds the opposite is true. By and large, the lower the charges, the better it is for investors. Understand more about the pros and cons with insights from Tom White, our investment research expert.

The value of investments can fall as well as rise and that you may not get back the amount you originally invested.

Nothing in these briefings is intended to constitute advice or a recommendation and you should not take any investment decision based on their content.

Any opinions expressed may change or have already changed.

Written by Tom White

Published on 30 Apr 20245 minute read

Passive funds – index trackers and exchange-traded funds (ETFs) that aim to track all or part of a market, rather than try to beat it – have a cost advantage compared to active funds. After all, simply following a market means investors can avoid paying expensive fund managers and analysts. They also save on the dealing charges that arise when those managers decide to chop and change the portfolio. Like all funds, their value can go down as well as up.

Lately, some of the charges on passive funds have been getting really low. For instance, State Street made headlines at the end of 2023 by cutting the annual charge (Ongoing Charges Figure, or OCF) on its US equity ETF, SPDR S&P 500 UCITS ETF, to just 0.03%.

This makes it the lowest OCF on the Bestinvest platform. However, competition in the space has driven down costs across the board, so investors can access other mainstream asset classes for not much more. You can currently track the UK equity market for a 0.06% OCF (Fidelity Index UK), the European market for 0.05% (HSBC European Index) and the Japanese market for 0.08% (iShares Japan Equity Index).*

Expensive mistakes?

Despite the bargains available, there are expensive trackers out there and picking the wrong one can cost you. After all, if you’ve been with the same mobile provider for a number of years your tariff may no longer be competitive. The same applies to index trackers.

Some providers have cut charges but not by enough to remain competitive. Others have launched new, cheaper products, but left more expensive offers in their ranges that can catch out unwary investors.

Investors who haven’t kept a close eye on their portfolio might be surprised to learn that they’re paying a 0.30% OCF to track the UK equity market (Virgin UK Index Tracking), 0.40% to follow the North American market (iShares MSCI North America UCITS ETF) or even 0.50% to buy a global tracker (iShares MSCI World UCITS ETF).*

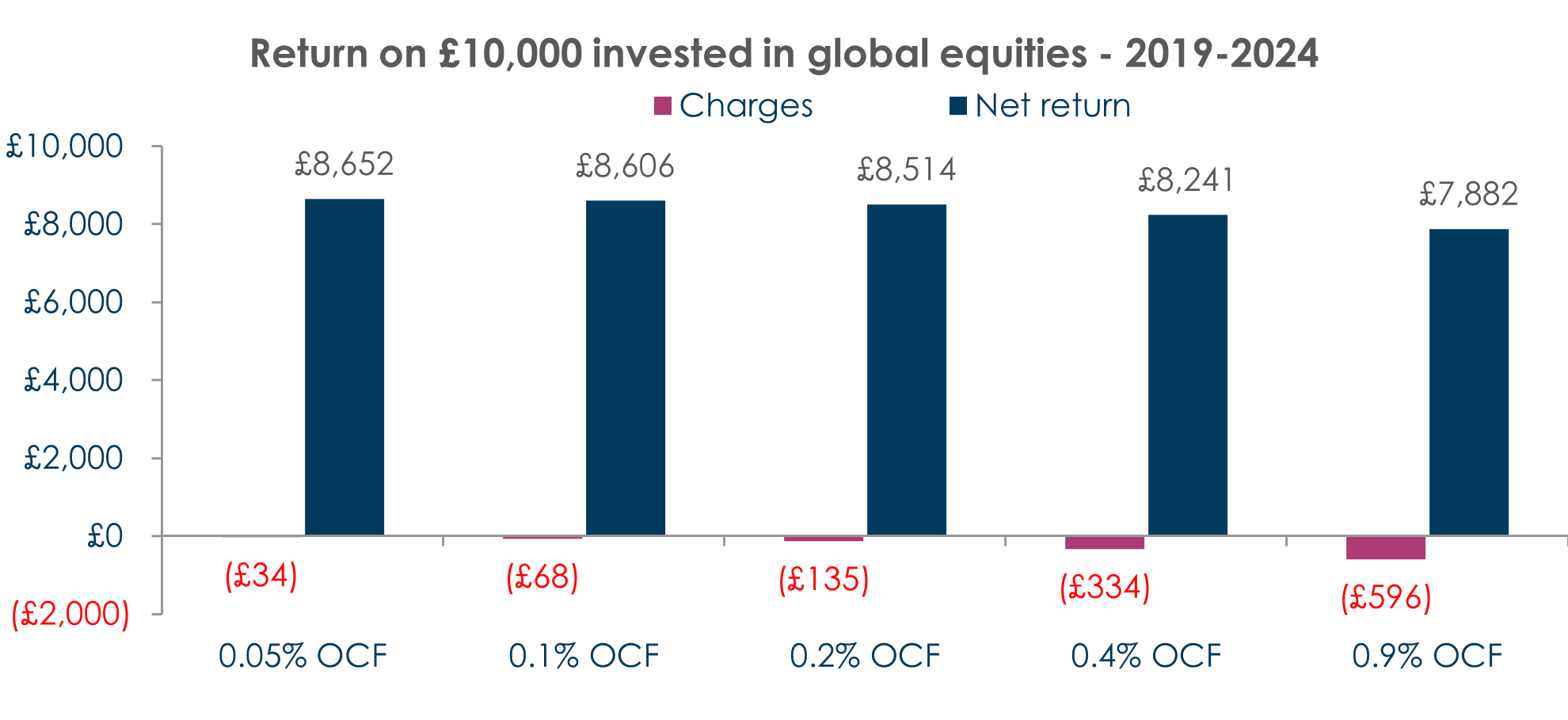

The chart below illustrates how much higher charges could hit performance on £10,000 invested in a global equity index (MSCI World) over the last five years, subject to various levels of annual charges.

Past performance is not a guide to future performance. Source: Morningstar. Performance as total returns in pounds sterling as at 1 April 2024

Charges from a 0.05% OCF (£34) would have been £101 lower than those from the 0.20% OCF over the period, and £300 lower than those from a 0.40% OCF. The charges from a 0.90% OCF, typical of an active equity fund, would have been £562 higher, though an active fund could add or lose value through the fund manager’s skill.

There’s more to charges than OCFs

The chart also shows that smaller differences in OCFs might have less of an impact. A 0.10% OCF is twice as costly as a 0.05% OCF, but in cash terms that would have amounted to a difference of just £34 over five years.

Small differences like this can be outweighed by other factors. These include:

- Trading costs within the portfolio – passive funds don’t trade as much as active funds, but they need to buy and sell when investors join and leave, as well as when stocks move in and out of the underlying index

- Tracking error – how closely a fund tracks the performance of its underlying index – also makes a difference to investor returns. Some providers are better than others at following an index, and those differences can prove costly

- Choice of index – the index itself can also make a difference. There are many indices tracking mainstream asset classes, such as US equities, but not all are created equal

- Trading costs when buying and selling – investors in ETFs incur dealing costs and are subject to a bid-offer spread (the difference between the buying price and the selling price). Investors in tracker funds can be hit with similar costs via dilution levies and swing pricing

- Replication method – some trackers buy all the shares on the underlying index to match it as closely as possible (“full replication”); others buy a selected sample that should provide similar characteristics (“sampling”). Some don’t buy any shares at all, instead buying derivatives – advanced financial instruments – designed to provide similar returns to the index (“synthetic replication”). There are advantages and disadvantages to each of these approaches

How Bestinvest can help

Investors who want to invest in Index funds but don’t have the time to do their own research might want to consider the ETF and tracker funds on our Best™ Funds List**, all of which have undergone testing against the measures noted above by our passive funds’ research team. They are also used in choosing the investments for our Smart Ready-made portfolios. Although we’ve given a few examples, we’re not recommending that you invest (or don’t invest) in these funds.

Competition in the index fund market means investors can now access most major markets at a very low cost. However, expensive products are out there, so those who have held ETFs or tracker funds for a number of years should check to see if they’re still competitive. The annual charge isn’t the only factor to consider when choosing a product, but it is a very important one. When it comes to passive funds, cheap generally is cheerful.

At Bestinvest you can chat to a financial planner about your investment strategy for no cost and no ongoing commitment - it's easy to arrange with our digital calendar. Investors who are looking for personalised investment recommendations can choose one of our low-cost advice packages to help build and maintain their portfolio.

Book free investment coaching

See our advice packages

Source

*OCF Source: Morningstar as of 26 April 2024

**The Best™ Funds List is a trademark of Bestinvest

Important Information

Source: MSCI. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI's express written consent.

Get insights and events via email

Receive the latest updates straight to your inbox.

You may also like…

Investing

Seven investing principles for DIY investors in volatile markets