Investment themes for 2023: staying defensive in a market recovery

After a troubled year for financial markets, investors may be hoping for better prospects in 2023. However, with a recession in prospect for many of the world’s major economies, considerable uncertainty remains. What are the themes likely to drive markets in the year ahead?

The value of investments can fall as well as rise and that you may not get back the amount you originally invested.

Nothing in these briefings is intended to constitute advice or a recommendation and you should not take any investment decision based on their content.

Any opinions expressed may change or have already changed.

Written by Daniel Casali, Chief Investment Strategist

Published on 09 Jan 20239 minute read

Most investors will be glad to see the back of 2022. It was a grim year for both bonds and equities, as we outlined in our year in review article. A number of the themes that have defined markets in the past year are likely to continue in the year ahead – the relative weakness of technology, for example, the dominance of value and dividend stocks – but there will be differences too; the revival of Asian markets, or the renewed interest in bonds.

Interest rates and inflation have been the key drivers for 2022 as investors have been forced to make significant adjustments to their expectations. There is hope for more stability in the year ahead, with higher rates largely priced in and inflation expected to fall back from the highs seen last year.

Nevertheless, there is still a lot for markets to navigate. Our base case is that global growth remains below trend rates, at around 1.5%, inflation slows and the Federal Reserve ultimately pauses on rates, but there are plausible scenarios on both the upside and downside.

It is possible that growth will outpace expectations if China's reopening goes smoothly, inflation slows markedly and central banks turn less aggressive. Alternatively, there are still significant risks: recessionary forces may prove far stronger than expected, the energy crisis may deepen, while geopolitical tensions – Russia/Ukraine, US/China, Taiwan, the Balkans – are mounting.

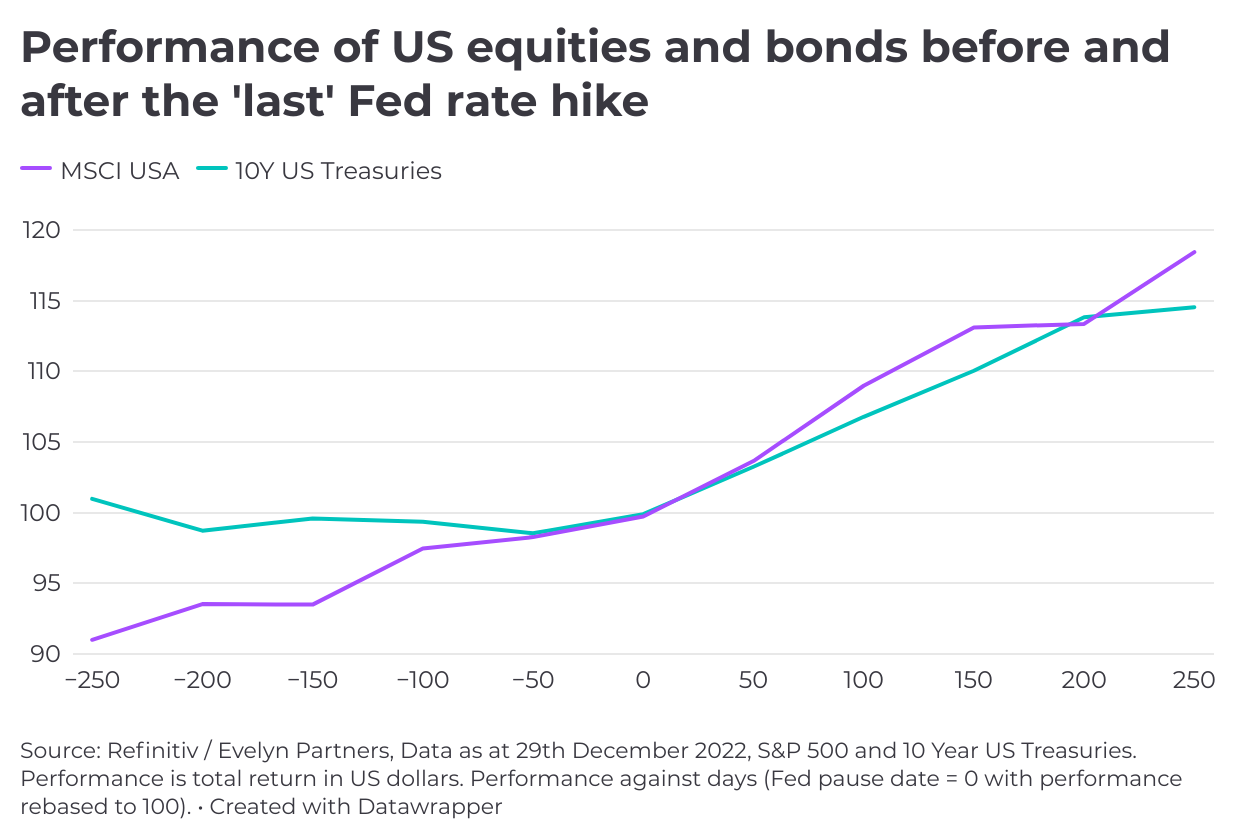

Assuming a soft-ish landing for the global economy, the stock market should be in a position to recover in 2023, but it is worth staying defensive in terms of portfolio exposure. Valuations are significantly lower than a year ago. The risks are that recession pushes down corporate earnings, and companies see an impact on supply chains and productivity from geopolitical uncertainty. Historically, equities have rallied when the Federal Reserve has paused on interest rates.

Equities and bonds rally when Fed pauses raising interest rates

Nevertheless, we believe there will be greater focus on the characteristics of individual companies after a period when macroeconomic considerations have been uppermost in the minds of investors. With this in mind, we have identified five key themes for the year ahead. We will explore each of these themes in greater depth over the coming months, so watch out for updates.

Playing the field for yield

Dividends became an after-thought for many investors at a time when interest rates were low, the cost of borrowing was cheap and capital growth considerations dominated. However, this is likely to change in the year ahead. At a time of higher inflation, the opportunity cost of not owning yielding stocks is higher.

The dispersion of dividend yields will give more opportunities for stock pickers. The number of companies that offer a higher income yield has grown to levels seen prior to the pandemic. In particular, areas such as energy, materials, utilities and consumer staples, are likely to see strong cashflows while commodity prices remain high. The supply squeeze will remain, while investment in new production remains low. That should allow these sectors to increase their pay outs to shareholders in the year ahead.

Our focus is on high-dividend stocks that are backed by pricing power and capital discipline. We are sticking with value-focused markets, such as the UK. In other words, it is worth keeping equity exposure to defensive areas of the market that are supported by healthy cashflow.

US markets: beyond the mega-caps

Having led global markets for much of the previous decade, the US mega-caps saw their share prices dive in 2022. A confluence of factors led to this weakness: valuations were frothy, they were sensitive to a shift in the interest-rate cycle, earnings growth slowed and sentiment towards them turned negative.

These stocks have become an increasingly dominant part of US and global indices. Our view is similar to that held at the start of 2022 – that these stocks could remain under pressure in the current environment.

While mega-cap valuations are now at more attractive levels, and they may benefit from a pause in Federal Reserve rate rises, they remain uniquely sensitive to the economic environment and, in some cases, face notable threats to their business models. They have been popular as a key area of visible growth, but that is no longer the case with other areas offering equivalent earnings potential. Rising rates in the US and some loosening of credit conditions in China should make a good environment for growth to broaden out from tech to some other areas of the market, both in the US and internationally.

Consumer discretionary stocks, such as Amazon and Tesla have been consistent losers under Federal Reserve hikes. Amazon’s business model relies on cheap labour, which is becoming more expensive. Social media giants such as Meta Platforms are facing significant regulatory threats as more research is done into the health and social problems created by their products. Equally, a number of these mega-caps derive a significant part of their earnings from advertising revenue, which has been sensitive to economic weakness.

The key risk to this is that rate rises fail to materialise or get endlessly pushed back, which would favour these mega-caps stocks once again. On balance, however, the risks are skewed to the downside.

Easing China uncertainty boost to Asian stocks 2023

China’s zero-Covid policy has been a sore spot with investors. It has continued to force periodic lockdowns, disrupting economic activity and slowing growth. It now appears to be reversing, with the government removing quarantine requirements for inbound travellers and scrapping the need for positive cases to quarantine at central facilities.

Weakening economic growth along with social unrest looks to have forced the Government’s hand. Retail sales, a gauge of consumer spending, fell by 5.9% year on year in November, worse than analyst expectations, while the economy is set to miss an annual 5.5% growth target that was already at its lowest in decades.

The Chinese Government’s change of heart has created some thawing of investor sentiment towards the Asian region in recent weeks. A lot of bad news had already been discounted in Chinese stock market valuations. If there is some easing of the zero-Covid policy and signs that the country is starting to open up, it could have a significant impact on both global and regional growth. Pent-up demand in China could compensate for weaker performance in the developed world.

In our view, the outlook for Asia looks brighter in the year ahead and valuations are more compelling. China’s reopening should lift growth across the region and improve sentiment towards its stock markets. If the US dollar continues to weakens, it may drive capital into the region. We are watching areas such as global mining companies, oil and gas and luxury goods, which could all be beneficiaries from this trend. Risks remain, but these appear to be well-understood by investors.

Bonds are back

Bonds have had a tough adjustment to make in 2022. A new interest rate and inflation regime has seen yields rise and capital values fall, even among ‘safe haven’ government bonds. However, that adjustment appears to have been made, with interest rate rises now priced into fixed income markets.

As a result, yields are now more attractive. The US 10-year treasury yield is at its highest level since 2010. The Fed has already done some heavy lifting by raising rates significantly in 2022 and at some point, in 2023, we believe the Federal Reserve will pause on rates. This may be an opportunity to reinvest selectively in longer-duration bonds (which have more sensitivity to interest rates).

Our focus is on US treasuries rather than gilts. There is a lot of looming gilt issuance, which needs to be digested by the market. We are concerned about where the buyers for this issuance will emerge. If they don’t, it may push yields higher. In general, we prefer US Treasuries, which also have historically better disaster insurance characteristics than gilts. We also like inflation-linked bonds as a hedge against stickier inflation.

More increases in interest rates are anticipated at the start of February, but inflation readings in Europe and particularly in the US are coming in lower than expected. The markets believe that the Federal Reserve will be forced to cut rates from January 2024 and we see an end to the tightening cycle by the summer of 2023 in the US.

Within credit, we prefer investment grade to high yield. High yield could be vulnerable in a recessionary environment and yields are not yet high enough to compensate for those risks. Within investment grade, we are focused on shorter-duration bonds, given relative spread levels over government bonds. We prefer to take interest rate risk through government bonds.

US dollar depreciation

The strong US dollar has been a feature of financial markets in 2022. It has benefited from rising rates, but also from its safe haven status in an uncertain environment. However, the rest of the world is catching up on interest rates and the US dollar’s yield advantage is diminishing. This has seen the US dollar weaken in the last few months of 2022, with flows into it slowing.

The US dollar is likely to see further weakness if the Federal Reserve pauses in 2022 as we expect, though volatile geopolitics may still provide support. Shifting geopolitical power may also be a factor: if the Chinese start to trade oil in renminbi, it could also act as a drag on the US dollar for example. This could be good news for gold, which tends to benefit from a weaker US dollar.

The influence of the US dollar will depend on an investor’s base currency. However, the pound looks cheap on a purchasing power parity basis against the US dollar, which has historically been a good guide. Inflation remains at higher levels in the UK and could persist longer, which would leave rates higher and give sterling an advantage.

There are multiple headwinds for sterling – a fragile economic outlook for the UK, its inherent cyclicality. However, given the remarkable strength of the US dollar and its current valuations, we believe the pound may strengthen in the medium term.

While the year ahead holds many uncertainties, there are reasons for investors to be selectively optimistic. Valuations are low, inflation and interest rates may be nearing their peak and China’s reopening provides a potential boost to global growth. Careful asset selection will be crucial, but there are opportunities even among the toughest conditions. Taking a defensive approach, investing in dividend payers in areas of the market that are less sensitive in rates remains central to our views. We will continue to revisit these themes throughout the year, updating our view as events evolve.

Sources

All figures have been sourced from Refinitiv/ Evelyn Partners

Important information

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

The value of an investment may go down as well as up and you may get back less than you originally invested.

Past performance is not a guide to future performance.

Get insights and events via email

Receive the latest updates straight to your inbox.

You may also like…

Investing

Seven investing principles for DIY investors in volatile markets