Keeping perspective in bear markets

Central banks are aggressively tightening policy to tame inflation as the US enters a bear market, and equities start to look attractive after recent falls. What does this mean for investors?

The value of investments can fall as well as rise and that you may not get back the amount you originally invested.

Nothing in these briefings is intended to constitute advice or a recommendation and you should not take any investment decision based on their content.

Any opinions expressed may change or have already changed.

Published on 17 Jun 20225 minute read

Global equity markets have sold-off as central banks such as the US Federal Reserve and Bank of England have begun aggressively tightening policy (raising interest rates and closing out their asset-purchase programmes) to tame inflation. The US stock market has entered ‘bear market’ territory, meaning a fall of 20% or more from its recent highs. Government bonds have also proven to be not much of a ‘safe haven’, with UK government bonds having fallen -15%[1] for the year so far. To see both equities and sovereign bonds fall in this way is an unusual situation, caused by fears around high inflation and, in turn, rising interest rates.

While these headlines make uncomfortable reading, it is worth keeping a couple of important points in mind. First, the areas that have been hit hardest recently (e.g. the US and sectors such as IT and consumer discretionary) are generally those that have outperformed strongly over the last couple of years, while earlier laggards (such as the UK and energy sectors) have fared considerably better. For sterling investors, its weakness of late has helped to cushion some of the impact of the headline falls in overseas markets.

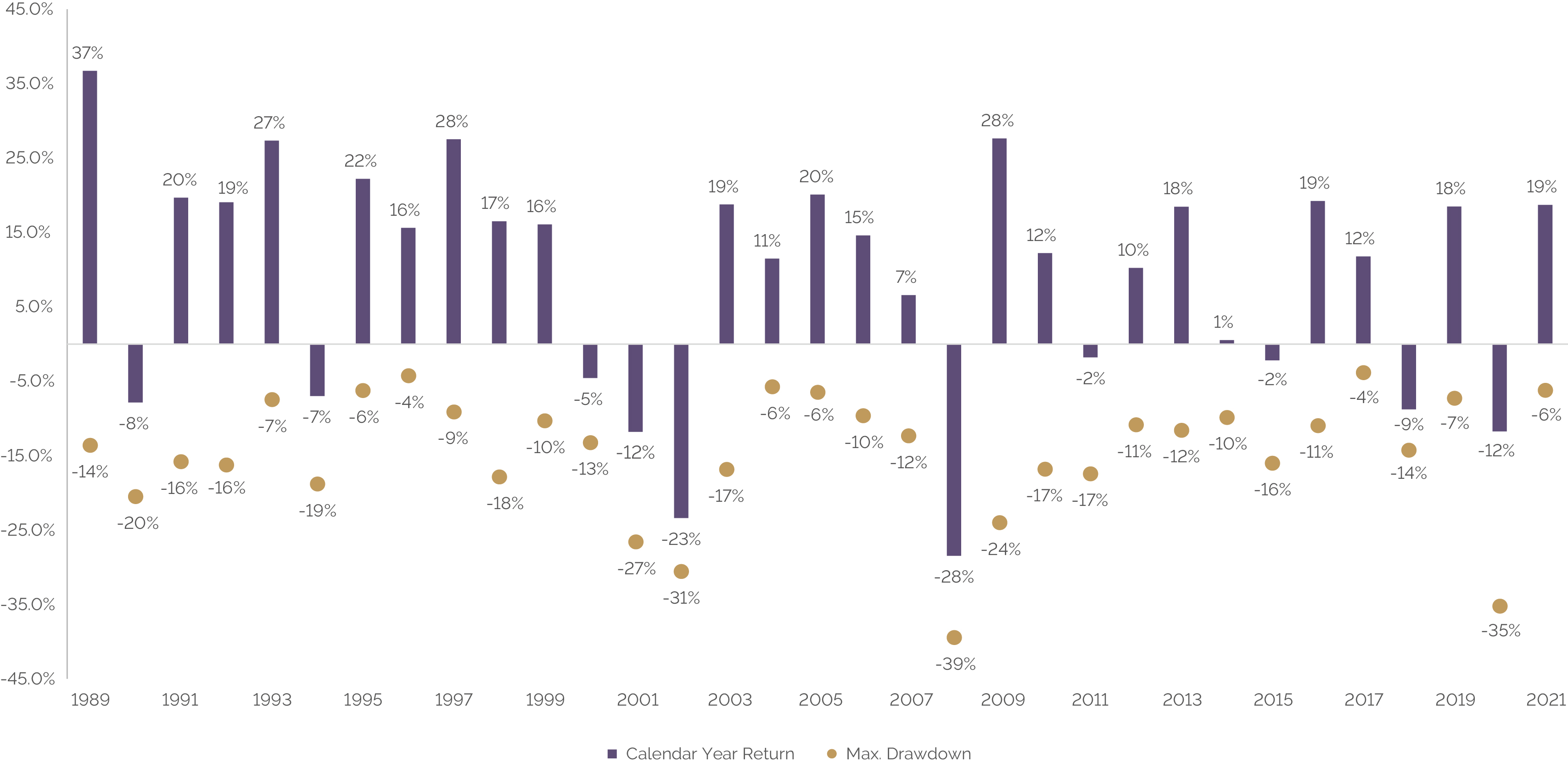

Second, markets are inherently volatile. Indeed, it is this uncertainty that one embraces when investing in riskier assets, with the ability to take a longer-term view enabling the investor to look through the noise and take advantage of opportunities as they arise. The chart below looks back to 1989 and shows both the annual return of UK equities as well as some of the news-grabbing drawdowns (high point to low point falls) within that year.

MSCI United Kingdom – maximum drawdown and full-year calendar return

Our view

Although part and parcel of investing, market falls are never comfortable, and it is important to keep a cool head and remain disciplined when dealing with these events. Central banks have been somewhat behind the curve as their view changed from inflation being transitory to persistent, meaning they are playing catch-up. They are also aware that the more they do now, the less harsh intervention will be needed in the future. Markets have moved to price in rapid hikes over the next 12 months but then a plateauing.

Equities have responded with an understandable devaluation in terms of earnings multiples, and indeed on some measures this looks a little overdone. At the same time, the fundamental corporate outlook is still robust with companies generally exhibiting robust profit margins and solid earnings forecasts for this year and next. Assuming markets can avoid negative feedback loops, and inflation does peak in the next few months as seems likely, there may well be opportunities on some oversold parts of the market.

Against this, there are some clear signs of trouble brewing on the horizon, and some evidence that we are getting towards the late part of the economic cycle. This is not a reason to batten down the hatches, and there are relative risks of being out of the market and missing out on some of the best periods, many of which come after the toughest periods. Rather, it is important to recognise that different parts of the market experience tailwinds and headwinds depending on the stage of the cycle and being diversified can often help deal with an uncertain outlook.

Our strategy

Those investors who regularly read our insights will be used to us saying that it rarely pays to change an investment strategy during times of market dislocation and volatility. This has generally been the right approach in the past, and we think the same applies now.

Within our central guidance, and reflected in appropriate mandates, we continue to favour diversification across equity markets, by country, sector and style. Having a reasonable exposure to the UK equity market has been a benefit and we expect that to continue while, for overseas equities, currency movements are also moderating some of the falls.

Back in March, we updated our guidance to close out our inflation-linked government bond exposure, and suggested keeping interest rate exposure (duration) low. This means we have had little exposure to the sell-off in government bonds and have generally benefited from alternative asset-class exposures instead.

As we look to the future, while we see the potential for a bounce as fundamentals reassert themselves, we are cognisant of some of the storms gathering on the horizon. We think it is important to retain equity exposure and topping-up some of the oversold areas can be a useful strategy. At the same time, starting to position for the later stages of the cycle can also be sensible, in defensive companies and those whose earnings are not predicated on accelerating economic growth.

With the sell-off in government bonds, this asset class is also starting to look feasible for us, in a way it hasn’t for more than a decade. Longer-term yields are now above longer-term inflation expectations, and these assets can start to act as a form of insurance against future downturns. For appropriate mandates, we are therefore advocating incrementally adding to core government bonds as well as continuing to be positioned in physical gold positions which can perform a useful part in portfolios against a range of risks.

Summary

We continue to monitor markets carefully, keeping cool heads and investment discipline to avoid overreacting to short-term noise while guarding against complacency. Short-term pessimism and devaluation in equity markets may well prove to be overdone and there is scope for a bounce as fundamentals reassert themselves. In the medium term it will be important to adjust our allocations as the economic and market cycle continues to turn, but plenty of opportunity exists for investors with a suitable long-term time horizon who can look through the noise.

[1] Source: Bloomberg. Markit iBoxx GBP Gilts index, 31/12/21 to 15/6/22.

This article is solely for information purposes and is not intended to be, and should not be construed as investment advice. Whilst considerable care has been taken to ensure the information contained within this commentary is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information. The opinions expressed are made in good faith, but are subject to change without notice.

Get insights and events via email

Receive the latest updates straight to your inbox.

You may also like…

Investing

Seven investing principles for DIY investors in volatile markets