Maximise your cash: should you save or invest?

Get straightforward answers about cash savings, calculate a savings buffer to suit your circumstances, and dig deeper into how you can grow your money. If you've got cash savings you'd like to put to work or if you're keen to invest in an ISA or SIPP but don't know where to start, this roundup is for you.

The value of investments can fall as well as rise and that you may not get back the amount you originally invested.

Nothing in these briefings is intended to constitute advice or a recommendation and you should not take any investment decision based on their content.

Any opinions expressed may change or have already changed.

Written by Frances Bruce

Published on 05 May 20234 minute read

It’s still early in the new tax year – the perfect opportunity to get ahead and decide how you want to make the most of your cash savings.

Let’s get to it.

Common misconceptions about cash – insights from our Head Investment Coach

There are many misconceptions about cash savings. All our investment Coaches are qualified financial planners. We asked our Head Investment Coach, Matt Morgan, to share his cash savings insights:

Calculate a savings buffer to suit your circumstances

It’s a good idea to have 6-12 months expenditure in your cash savings. This savings buffer would cover short-term unexpected costs and planned expenses, such as renovations, big holidays, or a new car.

When you allocate your savings in this way you can invest for longer, because you are not reliant on your portfolio to help you cover short-term costs.

Recent examples include the Covid crash and last year’s market volatility. Even though it was an uncomfortable time financially, those with cash savings had some reassurance.

Digital or smart tools can help you manage your money

If you’re keen to make informed decisions about your money, digital or smart tools can be a useful resource. For example, studies show that over the long-term investing has on average, outperformed cash1. A digital or smart tool can help you simulate how expert insights such as this one could play out for your circumstances.

Grow my money is a smart tool that lets you see how your money could perform if you chose to invest it. You can compare monthly contributions with different risk levels and timeframes. The digital calculator does the rest.

A clear investment strategy can keep you focused

Very few people (if any at all) can time the markets. A clear investment strategy is critical as it creates peace of mind and can keep you on track to achieve your financial goals. When you invest for the long-term with a clear strategy it can help silence short term market noise.

Many people choose to drip feed regular smaller amounts rather than lump sums (and can benefit from something known as pound cost averaging).

An easy way to do this is to set up regular saving. This works like a direct debit: you choose how much money you want to set aside to invest every month and the amount is automatically transferred. It’s an easy way to get your money working harder for you.

The best way to grow your money? Consider combining cash savings and investments

A combination of an emergency fund and a long-term investment strategy can be an effective way to grow your money:

- An emergency fund can ring fence your cash for unexpected costs, so you can see how much money you have left over to invest (also known as your ‘capacity’ to invest)

- If you keep all your money in cash right now, it still loses value versus inflation

- A long-term strategy helps you understand what you need to do to achieve your goals, what your appetite for risk is and reassurance that you’re doing what’s right for your circumstances

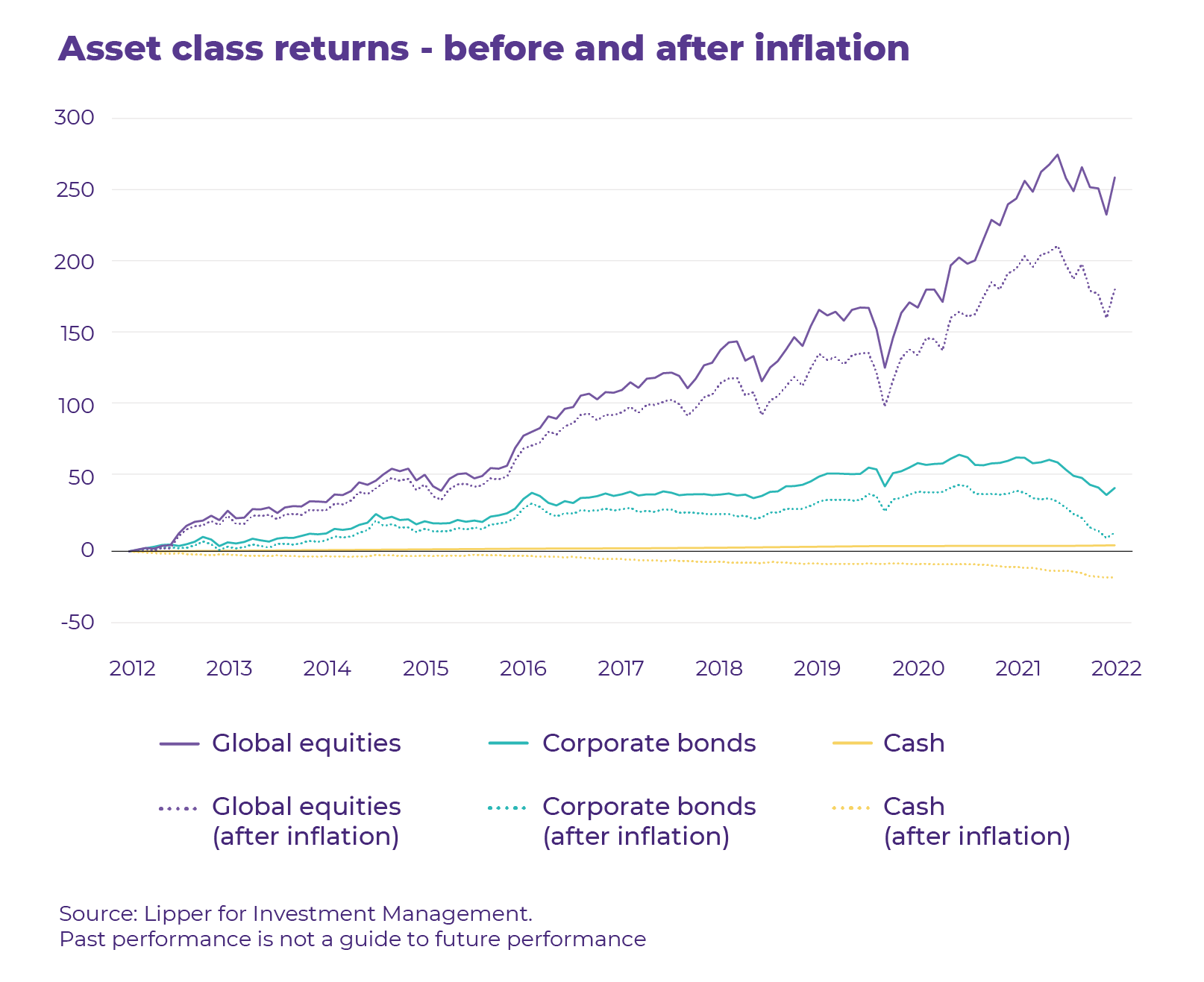

Compare bonds, equities and cash before and after inflation

As the chart below illustrates, the interest rates available on cash have typically been lower than inflation. This means that over time, the spending power of cash has fallen – you might have more in pound terms, but those pounds are worth less when you try and buy something.

Information about this chart

Cash: The Sterling Overnight Index Average; Bonds: Markit iBoxx Sterling Corporates; Equities: MSCI World; All returns are total returns; Data is to 1 August 2022

Bonds have performed better, but even their returns have been partly eaten away by inflation. And because the income they pay out is fixed, they tend to suffer if inflation rises.

Equities on the other hand are a play on human progress – economies typically grow over time as technologies improve and productivity rises, generating greater profits for investors.

Nothing is guaranteed of course, but historically equity markets have delivered inflation-beating returns.

More insights on this topic:

- How you can stop inflation eating your cash

- Watch: investing versus cash savings

- When is the best time to invest?

- Managing investments through challenging times

Good to know

Not investing might seem safe – cash is low volatility after all – but volatility is just one type of risk. Leaving your money in a cash savings account leaves you open to another kind – the steady decline of purchasing power caused by inflation. That’s why we offer free coaching with qualified financial planners.

We can help you take the confusion out of cash savings

If you’d like to chat to a Coach about your cash savings, Matt Morgan and his coaching team are here to help you. It’s easy to book yourself in for a free 45-minute coaching session. No obligations, no strings, just straightforward expert insight.

Source

1 Refinitiv / Evelyn Partners. Investing is the MSCI ACWI annualised return since 18th April 1993 total return in GBP. Cash is UK 10-year gilts also in total return and in GBP.

Get insights and events via email

Receive the latest updates straight to your inbox.

You may also like…

Financial planning

Maximise your capital gains tax exemption before the end of the tax year

Financial planning