What’s next for UK stocks?

This is undoubtedly a precarious moment for the UK economy. However, when handled with care, we continue to believe there are opportunities within the UK stock market.

The value of investments can fall as well as rise and that you may not get back the amount you originally invested.

Nothing in these briefings is intended to constitute advice or a recommendation and you should not take any investment decision based on their content.

Any opinions expressed may change or have already changed.

Written by Daniel Casali, Chief Investment Strategist

Published on 28 Apr 20225 minute read

Recent data shows the UK economy is starting to slow. GDP rose just 0.1% between January and February1, while higher energy and food costs pushed inflation to a 30-year high in March2. To what extent will this impact the UK stock market?

The UK economy is facing a number of headwinds, including rising inflation, rising interest rates and decelerating growth. While UK GDP and the unemployment rate returned to pre-crisis levels at the start of this year, the balance of the economy still reflects the legacy of the pandemic: health and warehousing, for example, are operating above pre-crisis levels. Others, such as travel, remain well below their level prior to the pandemic.

Looking ahead, there are some potential bright spots: the Office for Budget Responsibility (OBR) forecasts that business investment will recover to pre-crisis level by the end of the year, having been weak for last two years3. The super-deduction, which allows companies to claim back tax on plant and machinery investments, should encourage companies to bring forward expenditure into this year. If supply chain pressures ease, the outlook for business could improve further.

Tighten the purse strings…

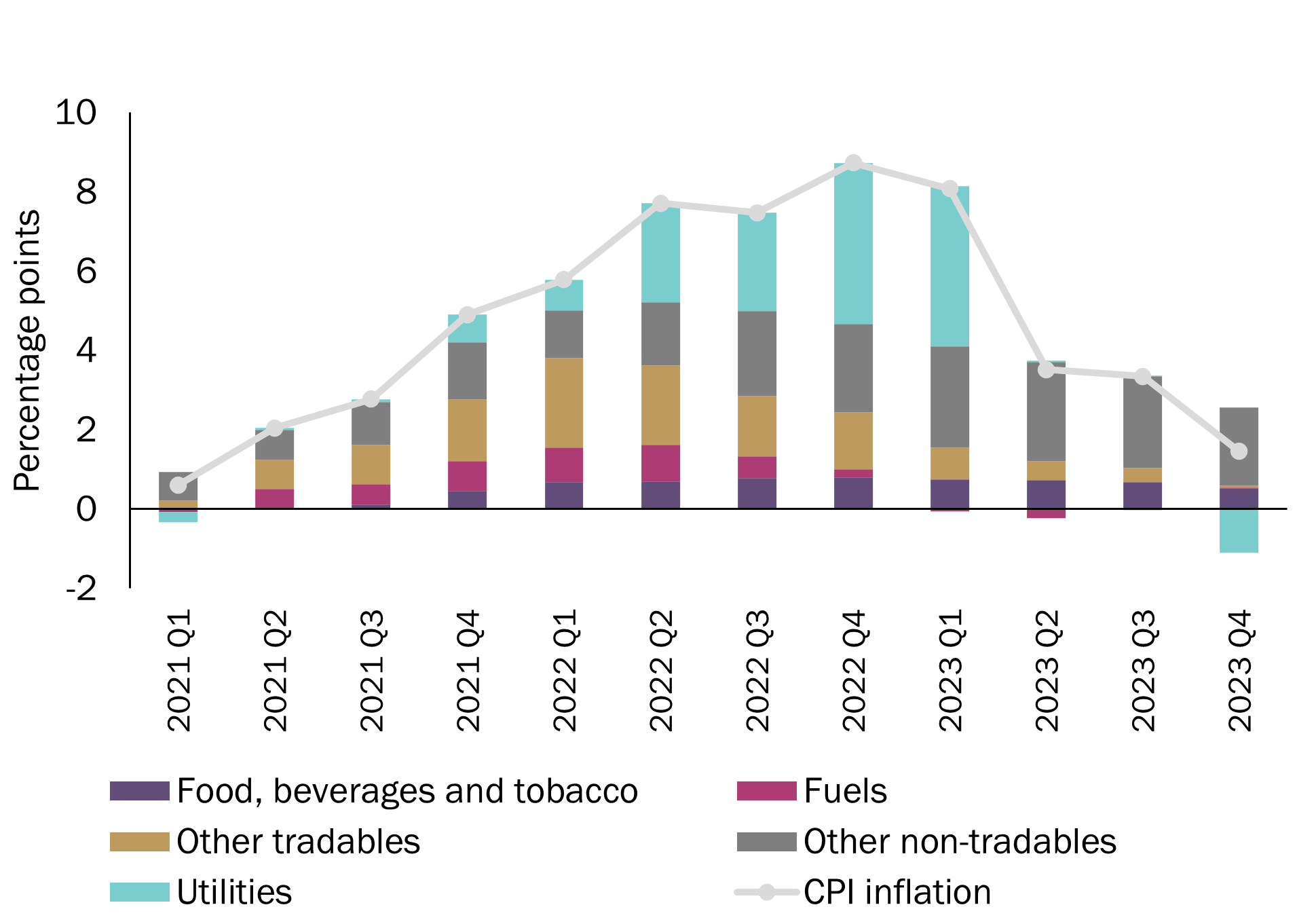

However, it is a very different picture for the UK consumer. As a net energy importer, the UK is exposed to shifts in energy prices. This is pushing inflation higher as seen in the March CPI print, with inflation hitting a 30-year high of 6.2% (year on year)4. Moreover, there is a lag between rising input costs in manufacturing and rising consumer prices, so it is likely that higher consumer prices will persist into the second half of the year. The OBR now believes that CPI will peak at close to 9% in the fourth quarter of this year5. This will continue to erode the purchasing power of UK consumers.

Chart 1: Utilities are expected to be the main driver of CPI

Source: OBR/Tilney Investment Management Services Limited, data as at 20 April 2022

Another challenge for UK households is that the Bank of England is expected to continue raising interest rates over the near term. The OBR forecasts interest rates will average 1.6% in the final quarter of 20226; while financial markets suggest they may reach 2% by the end of the year7. Whether or not they reach this level remains to be seen. The UK’s central bank has been clear that its priority today is tackling inflation via higher interest rates, though it may be forced to hit the pause button later in the year if the economy continues to slow.

The combination of higher inflation and higher taxes, driven by the increase in national insurance contributions, means household disposable income is set to fall by 2.2% in the 2022/23 tax year8. This is the largest fall since the 1950s. It would have been higher, but to try and offset the squeeze on incomes, Chancellor Rishi Sunak introduced a number of new policies, including increasing the NI threshold, a temporary cut in fuel duty and help on energy bills.

As this squeeze intensifies, households are already saving less and using some of the cash they banked during the pandemic. The war chest built up over successive lockdowns may cushion the impact a little, but much of it is held by wealthier households, which have a lower propensity to spend.

As ever, stock selection is crucial

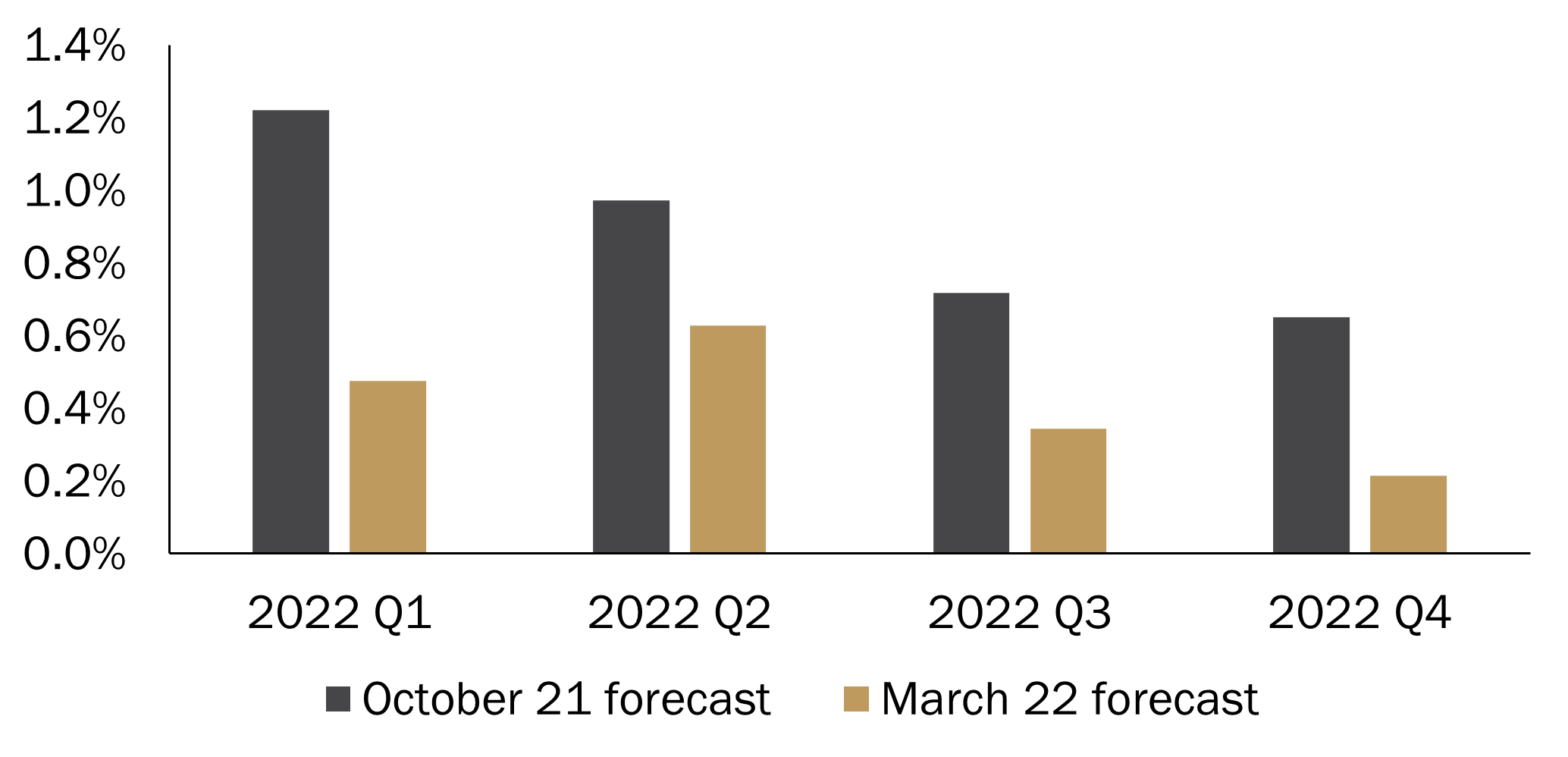

The economic picture is worsening, with the OBR revising its 2022 UK real GDP growth forecast down from 6% to 3.8%9. Similarly, this week the IMF revised its 2022 forecast down from 4.7% to 3.7%10. However, the UK economy is not the stock market. Many of the largest companies in the UK stock market draw their earnings from overseas; indeed, around two-thirds of FTSE 100 earnings are from abroad11. This means that many companies have relatively low exposure to domestic economic performance. Equally, the UK stock market continues to look cheap relative to many of its peers.

Chart 2: OBR October 2021 forecast vs March 2022 forecast (Real GDP growth % q/q)

Source: OBR/Tilney Investment Management Services Limited, data as at 20 April 2022

However, it does require careful navigation. From our work on the type of sectors that do well in a high inflation and medium growth scenario ─ our base case ─ we favour energy, healthcare and consumer staples. Helpfully, these sectors are relatively cheap and should also perform well in a weaker environment, where inflation is high and growth is low. Within these sectors, we favour companies with high and stable profit margins and pricing power, which allows them to protect those margins.

In contrast, our analysis suggests that cyclical sectors that are sensitive to consumer demand, such as consumer discretionary, don’t do as well in this type of macroeconomic environment. While some companies in this sector will be able to push through these headwinds, on balance, we believe value-oriented sectors should perform better.

This is undoubtedly a precarious moment for the UK economy. However, when handled with care, we continue to believe there are opportunities within the UK stock market, particularly for companies that earn revenues from overseas. We are focusing on those sectors that have historically performed well in a climate of high inflation and low/medium growth. When combined with careful stock selection, it’s possible to identify companies that can thrive whatever the economic weather.

Important information

This article is solely for information purposes and is not intended to be, and should not be construed as investment advice. Whilst considerable care has been taken to ensure the information contained within this commentary is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information. The opinions expressed are made in good faith, but are subject to change without notice.

You should always remember that the value of investments can go down as well as up and you can get back less than you originally invested. Past performance is not an indication of future performance.

Issued by Tilney Investment Management Services Limited, which is authorised and regulated by the Financial Conduct Authority.

Sources

1 ONS

2 ONS

3 OBR

4 ONS

5 OBR

6 OBR

7 Bloomberg

8 OBR

9 OBR

10 IMF

11 Reuters

Get insights and events via email

Receive the latest updates straight to your inbox.

You may also like…

Market news

2024 Autumn Budget Overview: The key announcements from Chancellor Rachel Reeves

Market news