Investing is for the long term

Investing should be for the long term – you should only invest money you’re happy to leave for at least five years. This is because, even though historically investments tend to rise in value over time, they can go down too.

Investing is not for next year’s summer holiday. What if the stock market – and the value of any investments – falls a month before you’re due to set off? You don’t want to get caught short and have to withdraw your money when your investments have just taken a hit, big or small.

Why are you investing?

You need to think about why you are investing, and more importantly when you will need the money. This is known as your investment time horizon.

If you’re investing for retirement and you’ll be working for another 40 years, you can afford to leave your money in investments that are considered riskier but could make you more money over the long term, such as shares. Time is on your side, so you can ride out the ups and downs.

If you need the invested money in five years, there’s less time for your investments to recover if the market happens to fall. You’d probably be better off with investments that may give you lower returns, but are less risky, such as UK Government bonds.

It might go without saying by now, but if you could need the money in six months, you should leave it in a cash account.

To find out more about investment risk, read our lesson.

Stock markets tend to go up over time

One of the reasons that investing is for the long term is because stock markets and wider economies tend to rise over time. This applies to everything from share prices and company earnings to wages and the price of household goods like your kitchen gloves or TV.

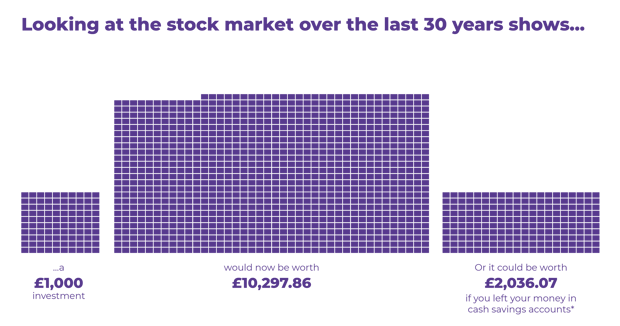

Looking at the stock market over the last 30 years shows a £1,000 investment would now be worth £10,297.86.

Compare this to the £2,036.07 that you’d have if you left your money in cash savings accounts* and, well, you get the picture.

Although past performance isn’t a reliable indicator of what will happen in the future, it shows the massive growth of the stock market over the last few decades.

Of course, there are ups and downs along the way. Stock markets tend to go through ‘cycles’ – periods of good performance followed by periods of bad. An important part of investing is being comfortable riding this out in exchange for the potential to make more money.

It’s about time in, not timing the markets

A common saying in the investment industry is – “it’s about time in, not timing the markets.” It means that rather than trying to time the short-term ups and downs in the stock market, you’re likely to be more successful by just investing your money and being patient so that it can hopefully increase over time.

The power of compounding

Compounding is one of the reasons long-term investing can give such great returns – it’s the snowballing effect of your returns generating more returns – win, win. Word on the street is that Albert Einstein called it “the eighth Wonder of the World.”

Imagine…

*Based on total returns from the MSCI United Kingdom index and Moneyfacts Average up to 90 Days Notice, from 06/1989 to 06/2019.

You invest £1,000…

… and get a return of 5% after one year = £1,050.

Another 5% in the second year = £1,102.50. That’s £2.50 more profit than in the first year (hold onto your hats…).

Yet ANOTHER 5% in the third year = £1,157.63, which is £5.13 more profit than the first year!

What’s the difference between trading and investing?

You might have heard about people earning huge sums of money over short periods of time by trading shares, currencies or cryptocurrencies. Trading involves buying and then selling the same investment in a short space of time – usually on the same day – with the hope of making a profit. This can potentially be very rewarding, but it’s also extremely risky and is almost impossible to get right again and again.

Investing is different. Rather than trying to second-guess daily stock market movements, you keep your money in a good mix of investments and watch them (hopefully) grow like Jack’s beanstalk! The slow and steady approach probably won’t make you rich overnight, but you probably won’t lose everything either (there are a lot of ‘probably’s). The tortoise won the race, don’t forget.