What is regular saving?

Regular saving is one of the most important ways investors can manage the short-term swings in financial markets. All it means in practice is paying a regular sum into your ISA, SIPP or general investment account rather than committing a lump sum in one go.

You can choose the amount you invest and where you invest it. It probably already happens with your company pension and even with your cash savings. All you need to do is set up a direct debit, decide on the appropriate investments and the investments will be made automatically every month.

Who might regular saving suit?

Regular savings will tend to suit more risk-averse investors, who would rather avoid big swings in their savings. It may also be right for those who want a more hands-off approach to their investments, rather than having to make lots of decisions. With regular savings, they can ‘set and forget’. Regular savings can help investors who prefer the discipline of feeding smaller sums into markets regardless of current conditions, rather than trying to pick the right moment to invest.

More on this topic: Goldilocks Principle and investment risks explained

What are the advantages of regular saving?

It can help you manage market volatility

Stock markets may be rational in the long-term, but in the short-term they can be flung about by anything from the latest GDP data to the oil price. With this in mind, one of the problems with investing a large lump sum into the stock market is that you may hit a bad moment. You could be investing when stock markets have gone up a lot and are set for a fall – as was the case in the 2000 technology boom or the 2007/08 financial crash. Investing regularly means that you benefit from ‘pound-cost averaging’, i.e. you buy at a variety of price points, so you don’t run the risk that you are investing a large lump sum at the top of the market. If someone invests £12,000 in a single investment, they may get lucky and buy at the bottom, but they are taking a significant risk on the level of the market on a particular day. However, if they invest £1,000 a month, they can smooth out their purchase price over time.

It takes the emotion out of investing

As humans, we are inclined to invest at the top of the market. Our instinct is to follow the herd and we are naturally reassured by the actions of other people. If they are buying, we are lulled into believing it must be a good time. Unfortunately, this isn’t always the case: when lots of people are very excited about stock markets, it can often be a signal to buy rather than sell. Investing regularly helps manage our instincts and invest in a disciplined way.

It's easier on your budget

Regular saving is also an easier way for most people to invest. You don’t need to find a pot of cash in one go, but instead can save little and often from your monthly income. You don’t have to think about whether it’s a good time to invest, or where your money is going. You only have to make one set of decisions and after that, everything happens automatically. For most people, this is a far less labour-intensive way to manage their finances.

What should I keep in mind when investing regularly?

Regular savings is designed to smooth out returns over time, but it won’t necessarily produce better returns than investing a lump sum. With lump sum investing, you may get lucky and hit a low point in markets, but it comes with greater risk.

Equally, if you already have a lump sum and have decades rather than a year or two to invest, it can be better to put your money to work as soon as possible. That way, you can benefit from investment growth and dividends over a longer period.

More on this topic: Building an investment portfolio

Can I see how my savings will grow over time?

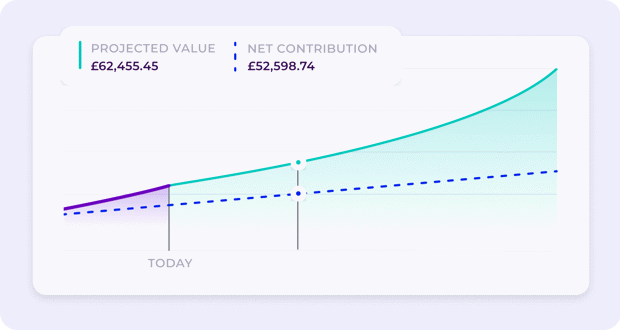

If you don’t have a Bestinvest account, the grow my money tool helps you understand how monthly savings can build up over time and how even relatively small changes can make a significant difference in the long term.

If you’re an existing Bestinvest client, you can access this tool in your account easily.

- Simply log in

- Click Life plan in the main menu

- Then select Grow my money

How should I invest my regular savings?

The right option for your monthly savings is personal and will depend on your long-term investment goals. If you are just looking for a straightforward, diversified investment portfolio, a ready-made, multi-asset investment option can remove a lot of the hard work.

Alternatively, a global income fund can be a good way to get access to a range of geographic regions and sectors all in one place, while also building up a long-term income stream. Our Best Funds list can give you some ideas.

Regular savings can be also be a good option when buying higher risk assets such as emerging market or smaller companies funds where sentiment can move significantly and volatility is high.

Set up monthly savings

It's easy to set up monthly savings with Bestinvest and you can start saving from just £50 a month.

FAQs – monthly saving with Bestinvest

What's the minimum amount you can save monthly?

The minimum amount for monthly savings is set at £50 as this is the minimum investment into most funds.

How to set up monthly savings?

First you will need to login and go to the account you would like to set up monthly savings for. There are two ways that you can contribute monthly:

- Monthly cash savings – this is useful option if you want to save a set amount of cash ready to invest at the right moment (and still benefit from a decent cash interest rate)

- Monthly investment savings – this is the right option if you want to invest a fixed amount into an existing investment each month

Important information

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

The value of an investment may go down as well as up and you may get back less than you originally invested.

This article is based on our opinions which may change.