You have probably worked hard for your money, so it’s natural to want it to work hard for you in return. This means it is important to review your pension regularly and make sure your money is held in high-quality investments that have the potential to grow for you over time. It’s important to make changes where appropriate.

It’s good to remember the value of your investments can go down as well as up, and you can get back less than you invested. To assist with making informed decisions about your pension investments, here are insights from our pension and investment experts, to help you keep your retirement plans on track.

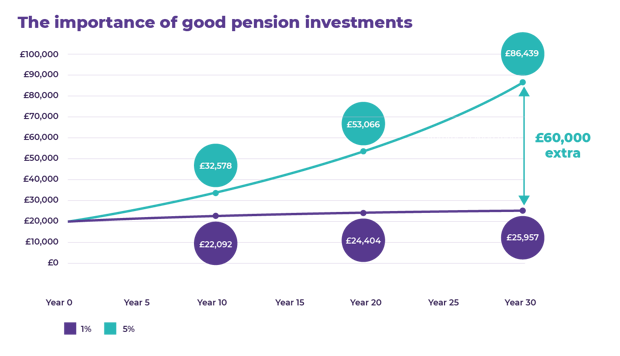

How different levels of return can affect your portfolio

Just how big a difference can the return on your investments make over time? We’ve crunched the numbers and created examples of both in the chart below to give you an idea.

- The chart shows two £20,000 pensions left untouched for 30 years

- All figures quoted are exclusive of any fees which may vary from provider to provider and are compounded annually. These fees would reduce the overall return of your investment

- The first pension has higher risk investments and assumes investment returns of 5% per annum

- The second has lower risk investments with an assumed growth rate of 1% growth a year

- All figures quoted are for illustrative purposes only and these example returns are not guaranteed, so you could get back more or less than this

Higher risk investments generally have a greater potential to provide higher returns over the long-term, but with this comes the bigger chance of losing the money you invest. Any investments you make within your pension or otherwise should be in line with your attitude towards taking financial risks.

- Over 30 years we can see the first pension growing to £86,439 – that’s £60,000 more than the second!

- Of course, not everybody has three decades to let their pension grow before they retire, but even over 10 years, the first pension outpaces the other by more than £10,000

Possible solutions for your pension investments

If you think your investments could be doing better, don’t panic – scroll down to find out more about how our Best SIPP or range of risk-rated Ready-made Portfolios could help your retirement plans.

Even if your pension investments are performing well, it’s important to bear in mind that you still need to check up on your pension at least annually. An investment might have been performing well in the past, but there’s no guarantee that it will continue to in the future.

Go deeper – Find out how one free 45-minute investment coaching session helped Alistair get his portfolio and early retirement plans back on track.

How Bestinvest can help investors get their pension back on track

At Bestinvest you can invest with as much expert support as you like. Although we cannot give individual pension advice, if you have questions about your pension or would like to know more about anything discussed in this article you can give us a call and talk to our friendly team on 020 7189 2400.

Investors can choose from a range of options to help get their pension investments back on track:

- Bestinvest’s Self-invested personal pension, the Best SIPP, gives you plenty of options to make sure your money is working hard for your future. It’s important to remember SIPPs are not suitable for everyone as they can cost more than other pensions. If you don’t want to invest across different asset classes or don’t think you will make use of the investment choices that SIPPs give you, then a SIPP might not be right for you

- Risk-rated Ready-made Portfolios – each one is built and managed by the investment experts at Evelyn Partners, our parent company and a UK leader in wealth management. They look after £63.0 billion of other people’s money (as of December 2024)

- Search for investments easily with our investment search tool – you can effortlessly filter and search investments across particular investment styles, geographical areas and more

- Get inspiration from one of our in-depth investor guides – download the latest edition of The Best™ Funds List to see our favourite funds for your pension investments (and any others!) Please note the Best Funds List is a trademark of Bestinvest

- Chat to a Coach about your pension – all our Coaches are qualified financial planners ready to listen and offer expert insights to help you get your pension back on track. It’s easy to arrange a free 45-minute coaching session and there’s no ongoing commitment. No personal advice will be given during these sessions but they can help you understand more about investing.

- Get affordable, personalised investment recommendations – existing Bestinvest clients can choose our cost-effective investment advice package designed to help investors build and maintain their portfolio

Coaching is not regulated by the Financial Conduct Authority.

Would you like to talk to a Coach about your pension?

If you’d like to know more about the Best SIPP or you have questions about your pension, just get in touch to see how we could help. You can call us on 020 7189 2400 or talk to a Coach about your pension with our pension specialists.