Why have we created it? Because there is now a two-tier system in the UK where pretty much everyone else is scooped up into auto-enrolment, meaning they’re saving for retirement without a great deal of thought, while you are having to do it for yourselves. According to the Office for National Statistics, from April 2018 to March 2020, only 20% of self-employed people were paying into a private pension scheme. On the other hand, 80% of employed people were doing so². This is not great news because it actually makes a lot of sense to put money into a pension. Aside from the obvious – that you’re going to need money to live on when you’re older and no longer working – pensions actually come with some hefty tax breaks that it’s a pity to miss out on.

Pension tax relief and allowances

Pensions are designed to help you save for the future. Because of this, you can’t take your money out until you’re 55 (rising to 57 in April 2028) but as an incentive to encourage you to save for the future, they come with great tax benefits. Put simply, no other mainstream investment can match the tax benefits that pensions provide. The Government gives you tax relief on pension contributions up to your annual allowance. Anything you invest will be topped up by 20% automatically, and higher and additional-rate taxpayers can claim back another 20% or 25% respectively through their tax returns. The following table shows how much three people on different tax rates actually pay out for a £10,000 pension contribution.

| Pension value | Basic rate | Higher rate | Additional rate |

| How much each person pays into their pension | £8,000 | £8,000 | £8,000 |

| How much the Government adds | £2,000 | £2,000 | £2,000 |

| How much can be claimed back via a tax return | £0 | £2,000 | £2,500 |

| Total tax relief | £2,000 (20%) | £4,000 (40%) | £4,500 (45%) |

| Total amount each person pays out for their £10,000 pension contribution | £8,000 | £6,000 | £5,500 |

Examples of how tax or tax relief may apply are based on our understanding of current tax legislation. Whether any tax will be payable, at what level it is charged and whether you qualify for tax relief will depend upon individual circumstances and may be subject to change in the future.

The investments in your pension will also grow free from income tax and capital gains tax and when you eventually come to use the money in your pension, you can take out 25% as a tax-free lump sum, subject to a new maximum amount of £268,275, with effect from 6th April 2024.

How much can you pay into a pension?

Every year you can personally contribute as much into a pension as you have earned, usually up to a maximum of £60,000 (in the current tax year). This £60,000 annual allowance is tapered down for higher earners. The allowance reduces by £1 for every £2 of adjusted income received over £260,000, down to a minimum of £10,000 for those with adjusted income of £360,000 or more.

Carry forward is useful for higher earners – particularly if your income fluctuates

Pension carry forward allows you to make pension contributions that are above your annual allowance by carrying over unused allowances from the last three tax years. This can be useful if your income changes every year. If you have had a particularly good year and would like to make a big pension contribution, you could pay in extra by carrying forward any unused allowance from a year where you earned less. You won’t be able to make pension contributions above your earnings in the current tax year (unless you run your own business – see below), but by using carry forward you could still pay in more than you would otherwise be able to.

Pension tax benefits if you have a limited company

If you have your own limited company you can either make pension contributions from your own personal funds or through your company – these are called employer contributions. They are not limited by your earnings, which makes them particularly useful if you pay yourself a low salary or take most of your income through dividends.

Employer pension contributions are treated as an allowable expense so can be used to reduce your corporation tax bill (contributions must pass HMRC’s 'wholly and exclusively' test and the rules over this can be complex). If you’re making employer contributions, the government won’t top these up like they do when you make contributions from your personal funds.

Every little counts with pensions

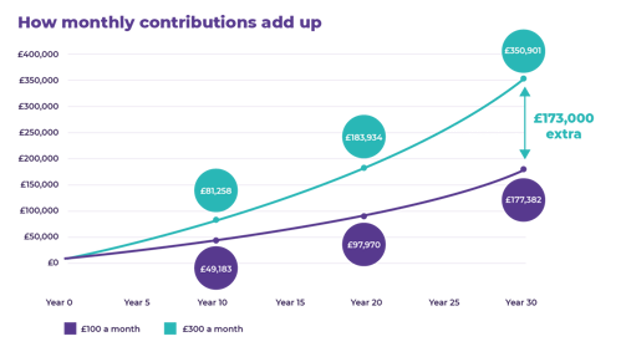

People often find saving for retirement off putting – or even futile – because they can’t envisage ever saving up enough, particularly with the constant media attention on the huge sums we’ll need. Our message here is very clear– save what you can because when it comes to long-term investments like pensions, every little really does count. Why? Because of the power of compounding. This is the snowballing effect that happens over time as your investment returns generate more returns. Even with quite modest sums, under the influence of compounding, you are likely to see your savings grow quite substantially over time. Have a look at our chart to see this in action.

All figures quoted are for illustrative purposes only.

This graph shows how a £20,000 pension would grow over 30 years if £100 was added every month and if £300 was added every month. We have used an annual growth of 5% compounded monthly.

Compounding is so powerful that some even claim that Einstein declared it the 8th Wonder of the World! Of course, the more you pay into your pension and the longer you leave it, the more opportunity there is for it to grow. But as you can see, even small amounts can make a big difference over time.

But remember – the value of your investment can go down as well as up, and you can get back less than you originally invested.

Monthly savings versus a lump sum

With pensions, you can pay in a monthly sum, which makes it easier to get into the savings habit. You can also pay in lump sums as and when you choose, which is good news for people who don’t earn the same every month or year.

The importance of good pension investments

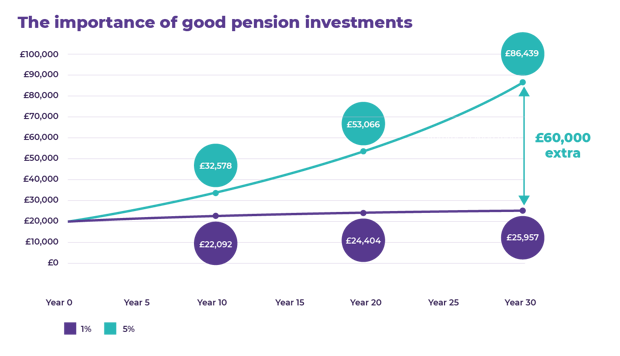

A common mistake that people make with pensions is not paying close enough attention to what they are actually investing in. This is bad news because not all investments are equal and if you’ve gone to the effort of earning your money and then saving it, you really do want to make sure that you choose decent investments so that your money will work as hard for you as possible.

The graph is based on investment returns of 1% and 5% per annum (exclusive of any fees which may vary from provider to provider), compounded annually. All return figures quoted are for illustrative purposes only and are not guaranteed.

This graph illustrates the impact that investment performance can have on your pension (or any other investments). It shows two £20,000 pensions that have been left untouched for 30 years. The first is full of good investments that generate a 5% annual return and the second has worse investments that pay out 1% a year. The difference is huge so we can’t emphasise this point enough.

The value of an investment, and the income from it, may go down as well as up and you may get back less than you originally invested.

Your choice of investments matters

Over 30 years we can see the first pension growing to £86,439 – that’s nearly £60,000 more than the second. Of course, not everybody has three decades to let their pension grow before they retire, but even over 10 years, the first pension outpaces the other by more than £10,000.

We have a guide – The Best™ Funds List – which highlights our favourite funds from across all major sectors. But do bear in mind that if you have an existing pension you may find that all our suggestions are not available. This is because many pensions – particularly older style pensions – typically have quite a limited choice of investments. That’s why many people opt for SIPPs (Self-invested Personal Pension), which may provide a much better choice of investments. You can find out more in our section below. The Best™ Funds List is a trademark of Bestinvest.

However, SIPPs are not suitable for everyone. If you don’t think you will make use of the investment choices that SIPPs give you, then a SIPP might not be right for you as they may be more expensive than other pensions.

Don’t pay too much in pension charges

All pension providers charge fees in exchange for looking after your pension but the amount they charge varies dramatically. While cheapest isn’t necessarily the best, paying over the odds can make a real dent in the amount of money you’ll have in the future because the more you pay in fees, the less you’ll have left to invest.

Consider a SIPP (Self-invested Personal Pension)

SIPPs are a type of personal pension that give you a lot of control over your retirement savings. You get access to a much wider range of investments than traditional pensions and they make it easy to buy and sell investments, check your pension performance and make sure your plans are on track.

As well as adding new money, it’s also easy to transfer old workplace or personal pensions into a SIPP, making it easier for you to manage your retirement money. It could also mean you spend less money on charges.

When considering a pension transfer, it’s important to check the investment options available and whether you need the wider choice offered by a SIPP as a new arrangement may be more expensive, especially if you have a stakeholder pension. You should also compare the charges and ask if you will lose any valuable benefits or features or incur penalties. If the pension is an employer-related plan, check if the employer will cease to pay in benefits if it is transferred elsewhere. If you have an occupational final salary pension scheme it is very unlikely to be advisable to transfer and advice should be sought.

Bestinvest has a multi award-winning SIPP, the Best SIPP. It comes with low fees (we were voted the FT’s Best Low-cost SIPP Provider for the second year running in 2018), a huge range of investments and is easy to set up and manage online. You can open a Best SIPP with as little as £100, or you can set up monthly savings from £50. With Bestinvest, you also get access to our friendly and knowledgeable telephone team who can answer all your questions on investments and pensions.

Sources

¹ Office for National Statistics, Employment and self-employment by sex and age group, UK, 2011 to 2022, May 2023

²Office for National Statistics, Saving for retirement in Great Britain: April 2018 to March 2020, June 2022