Pensions and retirement

Start saving for the future, make the most of your pension savings or plan for retirement.

The value of a pension can go down as well as up – and you could get less than the amount that's been put in.

You should consider charges, investment choices and any valuable benefits that could be lost before combining any pensions.

Saving for retirement

Self-invested Personal Pensions (SIPPs) are popular with people who want control over their pension savings. They give you the freedom to choose investments that are right for you and manage them the way you want. See what the Best SIPP can do for you.

Pension tax reliefs, allowances and rules

Pensions come with generous tax reliefs and allowances, which can give your retirement savings a big boost. They also come with a number of rules that depend on your individual circumstances and these can change.

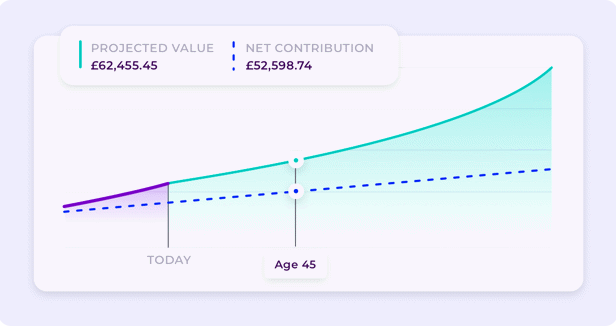

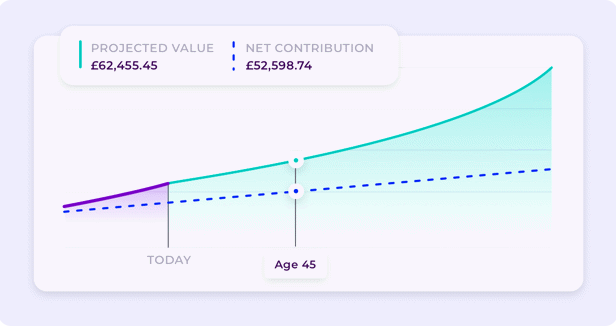

Getting the best from your pension savings

When your pension investments perform well, you reach your goals faster. Even smaller pension pots can grow substantially over time. We have all the insights and help you need to take control of your pension investments.

Pension consolidation

If you have a collection of old pension plans, should you combine them into one consolidated pension? It’s a choice that many people make because it’s easier to keep track of your retirement savings and on top of your pension investments. Is pension consolidation right for you?

Pensions explained

Are you looking for information on the different types of pensions, do you need a short cut through the pension industry’s infamous jargon or are you in search of an answer to a specific pension question? This section is here to help.

Your options at retirement

You have the freedom to choose how to take money from your pension when you retire. Find out more about lump sum withdrawals, income drawdown, annuities or even staying invested.